Closing Chase Bank Account Online: Easy Steps

Closing a Chase bank account may seem like a daunting task, but it’s actually a straightforward process. Whether you want to close your account for personal reasons or switch to a different bank, there are several methods available to you. In this article, I will guide you through the steps of closing your Chase bank account online. By following these easy steps, you can ensure a smooth and hassle-free closure of your account.

Before you proceed with closing your chase bank account, it’s important to take a few preparatory steps. Firstly, make sure you have opened a new account with another bank. This will ensure that you have an alternative place to keep your funds. Next, transfer any remaining balances from your Chase account to the new account. It’s also crucial to review your recurrent charges and subscriptions. Make sure to update your billing information with any companies that currently deduct payments from your Chase account. Lastly, if you have your salary directly deposited into your Chase account, remember to redirect it to your new account.

Once you have completed these preliminary steps, you’re ready to begin the process of closing your Chase bank account online. The following section will outline the exact steps you need to take to achieve this.

Key Takeaways:

- Before closing your Chase bank account, make sure to open a new account with another bank.

- Transfer any remaining balances from your Chase account to the new account.

- Review your recurrent charges and subscriptions and update billing information with the respective companies.

- Redirect your salary deposits to your new account.

- Follow the step-by-step process outlined in the next section to successfully close your Chase bank account online.

Steps to Close Chase Bank Account Online

If you’re looking for a convenient and hassle-free way to close your Chase bank account, closing it online is the perfect solution. With just a few simple steps, you can initiate the closure process without having to visit a branch or make a phone call.

Start by visiting the official Chase website and logging into your online banking account. Once logged in, navigate to the Secure Message Center, where you can communicate securely with Chase regarding your account.

In the Secure Message Center, click on “New message” to begin a new conversation. For the topic, select “Account Inquiry,” and for the subtopic, choose “Close my account.” This will direct your message to the appropriate department for account closure.

In the message, clearly express your intent to close your Chase checking or savings account. Provide your account number and full name to ensure accurate identification. It’s important to include these details to streamline the closure process.

After drafting your message, review it carefully to ensure it accurately conveys your desire to close your account. Once you’re satisfied with the message, click the send button to submit it to Chase for review.

After sending the message, you can expect a response from Chase within two business days. This response will provide further instructions and guidance on how to proceed with closing your Chase bank account. It’s important to follow these instructions carefully to ensure a smooth account closure process.

Closing your Chase bank account online offers a convenient and efficient way to manage your finances. It saves you time and eliminates the need to visit a branch or make a phone call. By following these steps, you can easily close your Chase account and move on to new financial opportunities.

Note: Closing a Chase bank account online is a simple and straightforward process. However, if you encounter any difficulties or have specific questions regarding your account closure, it’s recommended to reach out to Chase customer service for assistance.

Closing Chase Bank Account by Phone

If you prefer the convenience of closing your Chase account without visiting a branch or using the online method, you can opt to close it over the phone. Chase provides dedicated customer service numbers for different types of accounts:

Checking or savings accounts: Call 1-800-935-9935

Credit cards: Call 1-800-432-3117

When you call, make sure you have the necessary account verification information readily available. This includes your name, address, Social Security Number (SSN), debit card number, and the current balance in your account. It’s essential to provide accurate information to verify your identity and facilitate the closure process smoothly.

Once you’ve provided the necessary information, inform the representative of your intent to close your Chase account. They will guide you through the process and provide any specific instructions that you need to follow. Be sure to listen carefully and follow their guidance to ensure the closure is completed correctly.

Remember, closing your Chase account by phone is a simple and convenient option for those who prefer not to make a physical visit or use online methods.

For more detailed instructions on closing your Chase account online, please see Section 2.

Closing your Chase account by phone is a convenient option for those who prefer not to visit a branch or use online methods.

Closing Chase Bank Account in Person

If you prefer to close your Chase account in person, you can easily do so by following these simple steps:

- Use the Chase Branch Locator to find a nearby branch.

- Head to the branch with your identification, debit card, and any relevant account documents.

- Request to speak with a banker and inform them of your wish to close your Chase checking or savings account.

- The banker will guide you through the process, which may include transferring or withdrawing funds.

Closing your Chase account in person allows you to have a face-to-face interaction and ensures that any additional questions or concerns you may have can be addressed immediately.

Note: It’s important to note that due to COVID-19, some branches may have limited hours or may require appointments for certain services. Consider checking the branch’s website or calling ahead to confirm their operating hours and any specific requirements.

| Pros | Cons |

|---|---|

| You can have a direct conversation with a banker and get immediate assistance. | May require taking time off from work or rearranging your schedule to visit the branch during their operating hours. |

| Allows you to address any specific concerns or questions you may have during the account closure process. | If the branch is far from your location, it may be inconvenient and time-consuming. |

| Enables you to receive a confirmation receipt and any necessary documentation related to your account closure. | If you have a joint account, all account holders usually need to be present to close the account in person. |

Remember, closing your Chase account in person is just one of the options available to you. Take some time to consider the method that best suits your needs and preferences.

Closing Chase Bank Account by Mail

If you prefer a more traditional method, you can close your Chase account by mail. Simply compose a letter expressing your desire to close your Chase checking or savings account. Make sure to include your account details, such as your account number and name, your contact information, including your address, phone number, and email, and don’t forget to add your signature at the end of the letter.

Example letter:

Dear Chase Bank,

I am writing to inform you of my decision to close my Chase checking/savings account. Please find the details of my account below:

Account Number: [Your Account Number]

Account Holder: [Your Name]

Address: [Your Address]

Phone Number: [Your Phone Number]

Email: [Your Email Address]I would appreciate it if you could process my request as soon as possible. Thank you for your attention to this matter.

Sincerely,

[Your Full Name]

Once you have composed the letter, mail it to the following address:

National Bank By Mail

P.O. Box 36520

Louisville, KY 40233-6520

After sending the letter, it is advisable to wait for confirmation from Chase regarding the receipt and processing of your request. This will ensure that your account closure is being handled accordingly.

By choosing to close your Chase account by mail, you have the convenience of opting for a method that minimizes direct contact while still allowing you to effectively terminate your account.

Alternatives to Closing Chase Bank Account

When contemplating closing your Chase account, it’s always wise to explore alternatives before making a final decision. By considering these alternatives, you may find options that better suit your needs and may even provide an opportunity to improve your banking experience.

If you’re unsatisfied with your current account features or services, account modification could be a viable option. Chase offers a range of checking and savings accounts that cater to different financial goals and preferences. By transitioning to another Chase account, you can potentially enjoy enhanced benefits, lower fees, or better interest rates.

Engaging in a dialogue with Chase is another option worth exploring. By contacting their customer service department, you can express your concerns or dissatisfaction and discuss possible solutions. This direct communication may lead to better arrangements or offers to retain you as a valued customer.

By considering account modification or engaging with Chase directly, you open up possibilities for a more tailored banking experience without necessarily closing your Chase account.

Remember, exploring alternatives allows you to make an informed decision based on your specific needs and preferences. Take the time to weigh your options before closing your Chase account.

For a visual representation of alternatives to closing your Chase bank account, refer to the table below:

| Alternatives | Description |

|---|---|

| Account Modification | Transitioning to a different Chase account that better suits your needs and preferences. |

| Engaging with Chase | Contacting Chase directly to express concerns or dissatisfaction and discuss possible solutions. |

Note: Please note that the availability of account modification and the outcome of engaging with Chase may vary based on individual circumstances.

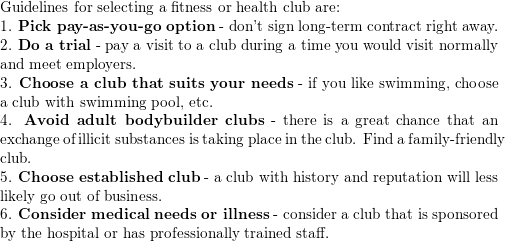

Checklist Before Closing Chase Bank Account

Before proceeding with closing your Chase account, it’s important to complete the following checklist items:

-

Open a new account: Before closing your Chase account, make sure you have opened a new account with another bank. Research and compare different options to find the one that best suits your needs.

-

Transfer any remaining balance: Ensure that you transfer any remaining balance from your Chase account to the new account. This will help avoid any potential fees or charges.

-

Update recurring payments and subscriptions: Take the time to update any recurring payments or subscriptions tied to your Chase account. This includes utilities, memberships, and other services.

-

Switch subscription billing: If you have any subscriptions that are currently billed through your Chase account, be sure to update the billing information with the new account details.

-

Redirect salary deposits: If your salary is currently deposited into your Chase account, make arrangements with your employer to redirect the deposits to your new account.

By completing these steps, you will ensure a smoother transition and minimize any potential issues that may arise when closing your Chase account.

Impact on Credit Score when Closing Chase Bank Account

Closing a Chase bank account typically does not have a direct impact on your credit score. Credit bureaus, such as Experian, Equifax, and TransUnion, do not have access to your transactional activity, so they cannot factor it into your credit score calculation. Therefore, closing a Chase account alone will not cause your credit score to increase or decrease.

However, it’s important to note that if you have outstanding negative balances, such as unpaid fees or a negative overdraft balance, it is crucial to settle them before closing your account. Failure to do so may result in Chase reporting the delinquency to the credit bureaus, which can have a negative impact on your credit score.

It’s recommended to review your account for any outstanding balances or pending transactions before initiating the account closure process. This will help ensure a smooth closure and minimize any potential negative consequences on your credit score.

“Closing a Chase account alone will not cause your credit score to increase or decrease.”

Can You Close Chase Bank Account Online?

In today’s digital age, many people prefer the convenience and efficiency of completing tasks online, including banking transactions. However, when it comes to closing your Chase bank account, Chase does not currently offer the option to close accounts directly online. Instead, you will need to explore alternative methods to close your account.

If you wish to close your Chase account, you have a few options available:

- Visit a Chase branch in person

- Contact Chase by phone

- Send a written request by mail

By utilizing one of these methods, you can initiate the account closure process and receive further instructions from Chase.

While it may be disappointing that Chase does not provide an online account closure option, rest assured that their dedicated customer service representatives are available to assist you in closing your account through the alternative methods mentioned above.

By Visiting a Chase Branch

If you prefer a face-to-face approach, you can visit a nearby Chase branch and directly speak with a bank representative. They will guide you through the account closure process and address any questions or concerns you may have.

By Contacting Chase by Phone

Alternatively, you can reach out to Chase through their customer service hotline. By calling the appropriate number for your account type, you can speak with a representative who will verify your account information and assist you in closing your Chase bank account.

Sending a Written Request by Mail

If you prefer to communicate via mail, you can write a formal letter expressing your intent to close your Chase account. Include all relevant account details and personal information in the letter, sign it, and send it to the designated address provided by Chase. Ensure you receive confirmation that your request has been received and processed.

While closing your Chase account online may not be an immediate option, utilizing the available alternatives will facilitate a smooth account closure experience.

Closing Chase Bank Account by Phone

Yes, you can close your Chase account over the phone. Simply call Chase’s customer service number at 1-800-935-9935 for checking or savings accounts, or 1-800-432-3117 for credit cards. Provide the necessary account verification information, such as your name, address, social security number, debit card number, and current balance. Inform the representative of your intention to close the account, and they will guide you through the closure process.

Closing your Chase account over the phone can be a convenient option, especially if you prefer not to visit a branch. The customer service representative will ensure all necessary steps are taken to close your account efficiently and securely.

If you have any questions or concerns during the phone call, don’t hesitate to ask the representative for clarification. They will be able to provide you with any additional information you may need regarding the closure of your Chase bank account.

| Pros | Cons |

|---|---|

| Convenient option, no need to visit a branch | May require longer wait times on the phone |

| Assistance from a customer service representative | Potential need to provide sensitive account information over the phone |

| Efficient closure process | May not receive immediate confirmation of closure |

Note: The content provided here is for informational purposes only. It is always recommended to directly contact Chase Bank for the most accurate and up-to-date information regarding closing your Chase bank account by phone.

Conclusion

Closing a Chase bank account can be done through various methods such as online, by phone, in person, or by mail. Before closing your account, it is important to complete a checklist of necessary steps and consider alternatives to closing. Remember that closing a Chase account typically does not impact credit scores unless there are outstanding negative balances.

To close your Chase account online, log in to the official website and navigate to the Secure Message Center to submit a closure request. If you prefer, you can also close your account by calling Chase customer service, visiting a branch in person, or sending a written request by mail.

Before proceeding with the closure, ensure that you have opened a new account to transfer any remaining balance, updated recurring payments and subscriptions, and redirected salary deposits. Considering alternatives such as modifying your account or engaging with Chase directly can also be beneficial.

Remember that closing your Chase account is a personal decision and it is essential to carefully evaluate your needs and financial situation before taking this step. By following the appropriate procedures and considering all aspects, you can successfully close your Chase bank account.

FAQ

How can I close my Chase bank account online?

The most straightforward way to close your Chase bank account online is by visiting the official Chase website, logging into your online banking, navigating to the Secure Message Center, and sending a message expressing your intention to close your account.

What are the steps to close a Chase bank account online?

To close a Chase bank account online, log into your online banking, access the Secure Message Center, draft a message expressing your intent to close the account, include your account number and name, and send the message. Expect a response from Chase within two business days.

Can I cancel my Chase bank account online?

Yes, you can cancel your Chase bank account online by sending a message through the Secure Message Center on the official Chase website, expressing your intention to close the account.

How do I terminate my Chase bank account online?

To terminate your Chase bank account online, log into your online banking, access the Secure Message Center, send a message expressing your desire to close the account, and include your account details and name.

Is it possible to close my Chase bank account online?

Yes, closing a Chase bank account online is possible by sending a message through the Secure Message Center on the official Chase website, expressing your intent to close the account.

How do I close my Chase bank account by phone?

To close your Chase bank account by phone, call Chase customer service and provide the necessary account verification information. Inform the representative of your intention to close the account and follow their instructions.

What is the process of closing a Chase bank account in person?

To close a Chase bank account in person, use the Chase Branch Locator to find a nearby branch, visit the branch with your identification, debit card, and account documents, request to speak with a banker, and inform them of your wish to close the account.

How can I close my Chase bank account by mail?

To close your Chase bank account by mail, pen a letter expressing your desire to close the account, include your account details, name, address, phone number, email, and signature, and mail the letter to National Bank By Mail. Await confirmation from Chase regarding the receipt and processing of your request.

What are some alternatives to closing my Chase bank account?

Before closing your Chase bank account, consider alternatives such as account modification, which involves transitioning to another Chase account, or engaging in dialogue with Chase to discuss better arrangements or offers.

What should I do before closing my Chase bank account?

Before closing your Chase bank account, make sure to open a new account, transfer any remaining balance, update recurring payments and subscriptions, switch subscription billing, and redirect salary deposits to ensure a smoother transition.

Does closing my Chase bank account impact my credit score?

Closing a Chase bank account typically does not impact credit scores, unless there are outstanding negative balances. Credit bureaus do not have access to transactional activity, so they cannot take it into account for credit scoring purposes.

Can I close my Chase bank account online?

Currently, Chase does not offer the option to close bank accounts directly online. To close your Chase bank account, you will need to contact Chase either in person, by phone, or by sending a written request.

It's great that you talked about how business insurance can provide financial protection against unexpected events and help ensure the…

I like that you mentioned how business insurance is essential for protecting your bottom line and the long-term viability of…