Excess liability coverage

Excess liability coverage, also known as personal liability umbrella insurance, provides an extra layer of financial protection above and beyond your existing insurance policies. Whether you’re a homeowner, a business owner, or a pet owner, excess liability coverage can help safeguard your assets in the event of a lawsuit or claim. This type of insurance is designed to cover the costs that exceed the limits of your primary policies, such as auto, home, or business insurance. By adding excess liability coverage to your insurance portfolio, you can have peace of mind knowing that you’re protected against unexpected liabilities that may arise. Whether it’s a car accident, a slip and fall incident on your property, or a dog bite, excess liability coverage is there to ensure that you’re not left financially vulnerable.

Excess Liability Coverage

Excess liability coverage is an important type of insurance that provides an extra layer of protection beyond the limits of your primary insurance policies. This coverage is designed to safeguard your assets and provide you with peace of mind in the event of a costly liability claim.

Overview of Excess Liability Coverage

Accidents happen, and unfortunately, they can lead to devastating financial consequences. If you are found liable for causing injury, property damage, or even death, the costs involved can be astronomical. This is where excess liability coverage comes into play. It acts as a safety net, providing coverage above and beyond the limits of your primary insurance policies.

What is Excess Liability Coverage?

Excess liability coverage, also known as umbrella insurance, provides additional liability protection beyond what is covered by your auto, home, or business insurance policies. It kicks in when the limits of your primary policies have been exhausted, giving you peace of mind that you will not be personally responsible for the remaining costs.

How Does Excess Liability Coverage Work?

In the event of a covered claim, excess liability coverage works by filling in the gaps left by your primary insurance policies. Let’s say you are involved in a car accident where the other party is seriously injured. If the medical costs and legal fees exceed the limits of your auto insurance policy, your excess liability coverage will step in to cover the remaining expenses, up to the limits of your policy.

Benefits of Excess Liability Coverage

There are several benefits to having excess liability coverage. The primary benefit is financial protection. Without this coverage, you could be left personally responsible for the costs of a liability claim that exceeds your primary policy limits. Excess liability coverage also provides peace of mind, knowing that you have an extra layer of protection in case of a catastrophic event.

Another significant benefit is the flexibility that excess liability coverage offers. It typically covers a wide range of liability risks, including bodily injury, property damage, personal injury, and even lawsuits. This means that regardless of the nature of the claim, your excess liability coverage can provide the necessary protection.

Types of Excess Liability Coverage

Excess liability coverage is available for both personal and commercial insurance needs. Let’s explore each type in more detail:

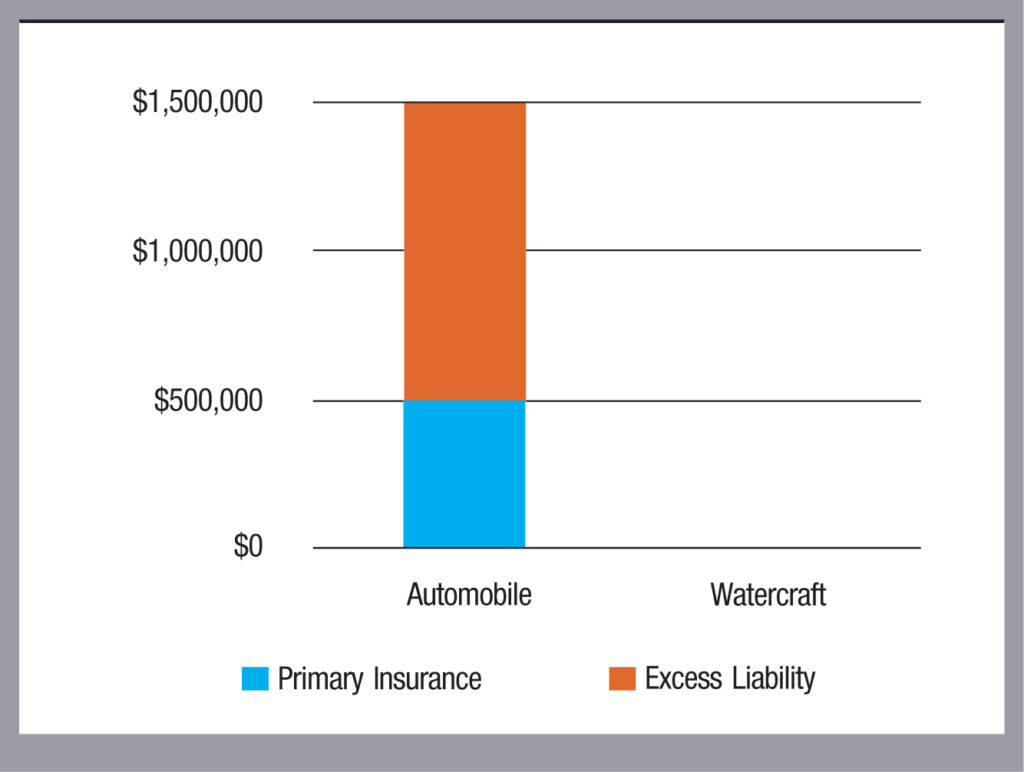

Personal Excess Liability Coverage

Personal excess liability coverage is designed to protect individuals and families from liability claims beyond the limits of their primary insurance policies. This coverage extends to various areas, including auto, homeowners, and even watercraft insurance policies. It provides an additional layer of protection to safeguard personal assets and future earnings from potential lawsuits.

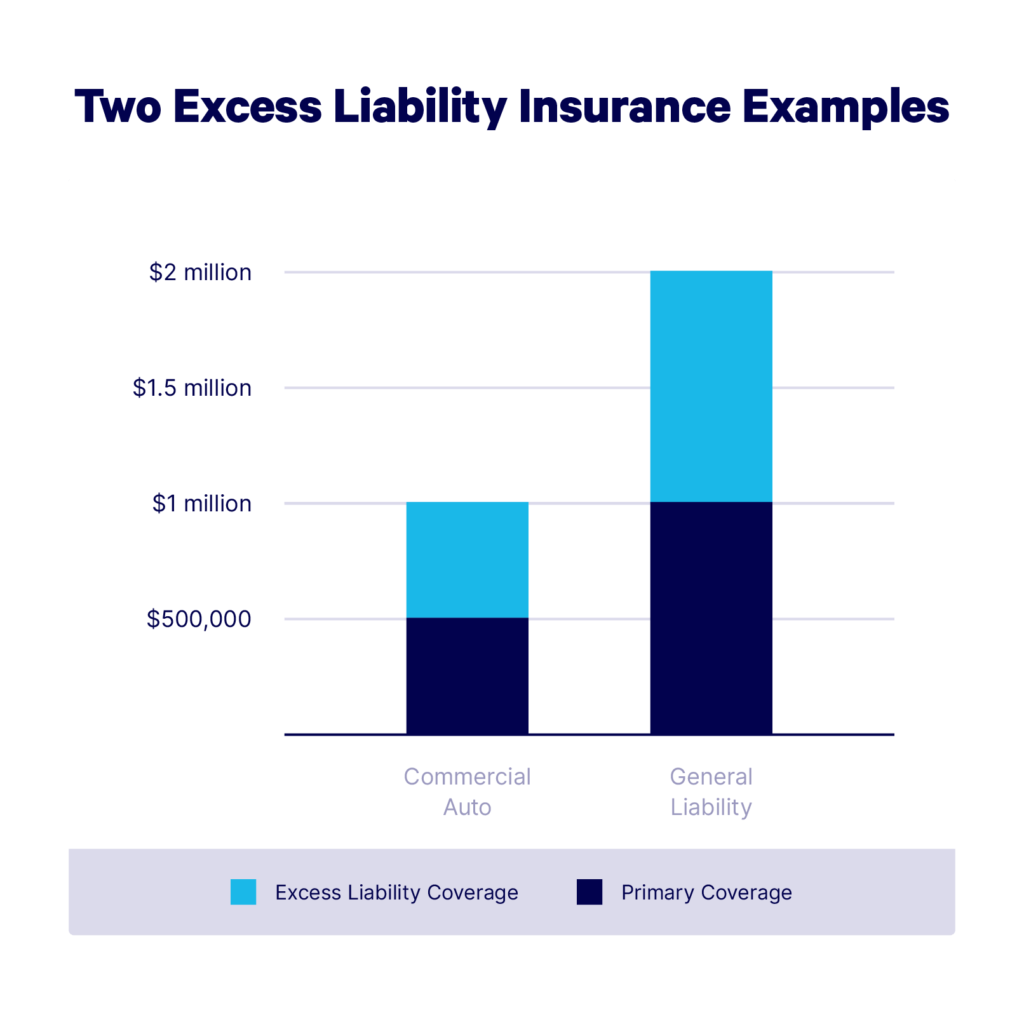

Commercial Excess Liability Coverage

Commercial excess liability coverage is tailored for businesses and organizations. It provides an extra layer of protection beyond the limits of general liability, commercial auto, and workers’ compensation policies. This type of coverage is especially critical for businesses that face significant liability risks, such as those in the construction, manufacturing, or healthcare industries.

Excess Liability Coverage and Umbrella Insurance

Excess liability coverage and umbrella insurance are often used interchangeably, but they do have some differences. While both provide additional liability protection, umbrella insurance can also fill in the gaps left by other types of insurance policies, such as homeowners or rental property insurance. Excess liability coverage, on the other hand, is typically an extension of your primary policies and does not cover other areas of risk.

Common Exclusions and Limitations of Excess Liability Coverage

Like any insurance policy, excess liability coverage also has its limitations and exclusions. It is essential to understand these before purchasing a policy to ensure you have the coverage you need. Some common exclusions include intentional acts, damage to your own property, and liability arising from professional services. It is crucial to read the fine print and consult with your insurance agent to fully understand the scope of your policy.

In conclusion, excess liability coverage is a valuable form of insurance that provides an additional layer of protection beyond the limits of your primary policies. Whether you are an individual or a business owner, having this coverage can help safeguard your assets and future earnings in the event of a costly liability claim. Remember to carefully assess your needs, explore the different types available, and consult with an experienced insurance professional to find the right excess liability coverage for you.

It's great that you talked about how business insurance can provide financial protection against unexpected events and help ensure the…

I like that you mentioned how business insurance is essential for protecting your bottom line and the long-term viability of…