Exploring What Qualifies as Online Banking

Welcome to my article where we will explore the world of online banking. In today’s digital age, managing our finances has become easier than ever before. Online banking, also known as digital banking, online financial services, internet banking, virtual banking, or mobile banking, has revolutionized the way we handle our money. With just a few clicks or taps, we can access our accounts, make transactions, and stay updated on our financial status.

Online banking is a term used to describe various methods that allow individuals to manage their banking activities through the internet. It offers a secure and convenient way to handle financial tasks without the need to visit a physical branch. Whether you prefer using a website or a mobile app, online banking provides flexibility and accessibility that fits into our busy lives.

Key Takeaways:

- Online banking provides a convenient and secure way to manage finances.

- There are various types of online banking, including website-based and mobile-based options.

- Online banking offers flexibility and accessibility, allowing individuals to access their accounts anytime and anywhere.

- Features of online banking include account management, bill payments, fund transfers, and more.

- It’s important to consider the pros and cons of different types of online banking to find the best fit for individual needs.

Traditional Banking: A Physical Approach to Banking

Traditional banking refers to the operation of brick-and-mortar banks with physical branch locations. These banks provide a wide range of financial services to customers, including savings and checking accounts, loans, mortgages, and investment options. They have a well-developed ATM network, allowing customers to withdraw cash, deposit checks, and access account information conveniently.

One of the advantages of traditional banking is the availability of in-person customer service. Customers can visit their local branch and interact with bank staff directly, addressing any concerns or inquiries they may have. This face-to-face interaction provides a personal touch and allows customers to establish a relationship with the bank.

Traditional banks often offer a variety of services beyond basic banking, such as financial planning, wealth management, and insurance options. These additional services can be beneficial for customers seeking comprehensive financial solutions.

| Key Features | Traditional Banking |

|---|---|

| Physical Presence | Brick-and-mortar branches |

| Financial Services | Wide range of options |

| ATM Network | Convenient access to cash |

| Customer Service | In-person assistance |

In conclusion, traditional banking provides customers with a physical approach to managing their finances and offers a comprehensive range of financial services. The in-person customer service and well-established ATM network contribute to a personalized banking experience. However, it is important for individuals to consider the pros and cons of traditional banking in comparison to other banking options to determine which approach best fits their needs and preferences.

Online Banking: Convenience at Your Fingertips

Online banking has revolutionized the way we manage our finances. By providing a user-friendly website, online banks offer customers the convenience of banking anytime, anywhere. Whether you choose a traditional bank that offers online banking services or an online-only bank, the benefits are undeniable.

With online banking, you can access your accounts 24/7 through a secure website. Gone are the days of rushing to the bank during their limited operating hours. Instead, you have the freedom to check your balance, transfer funds, and pay bills at your convenience.

The Convenience of Online Banking

Online banking provides a streamlined experience, allowing you to perform various banking functions from the comfort of your own home or on the go. Through a user-friendly website, you can:

- View account balances and transaction history

- Transfer funds between accounts

- Pay bills online

- Set up automatic payments and account alerts

- Manage your account preferences

With these features at your fingertips, online banking offers unparalleled convenience and flexibility.

Customer Support and ATM Networks

While online banking offers numerous advantages, it’s important to consider a few potential limitations. Customer support may be limited to online channels, such as live chat or email, which may not provide the same level of assistance as in-person interactions. It’s crucial to understand the customer support options available before choosing an online bank.

Additionally, online banks may have a smaller network of ATMs compared to traditional banks. This can result in fees when using out-of-network ATMs for cash withdrawals. However, many online banks now offer reimbursement programs to offset these fees or have partnerships with ATM networks to provide surcharge-free access to a larger network of ATMs.

It’s vital to review the ATM options and associated fees when considering an online bank to ensure accessibility meets your needs.

Image for reference:

| Pros | Cons |

|---|---|

| Convenience of banking anytime, anywhere | Limited customer support options |

| Access to a user-friendly website | Smaller network of ATMs, potential fees |

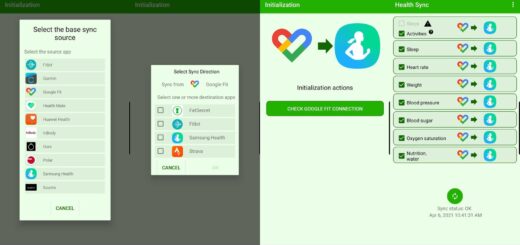

Mobile Banking: Banking on the Go

Mobile banking has revolutionized the way we manage our finances, offering convenience and accessibility right at our fingertips. With the rise of smartphones and tablets, individuals can now perform various banking activities through dedicated mobile applications, providing a seamless online banking experience on the go.

Similar to online banking, mobile banking allows customers to access their accounts and perform transactions anytime and anywhere. Whether it’s checking account balances, transferring funds, or paying bills, all these tasks can be conveniently done using a mobile device.

One of the key advantages of mobile banking is the flexibility it provides. People no longer have to be tied to their computers or physical bank branches to carry out financial activities. With just a smartphone or tablet in hand, they can perform banking tasks during their daily commute, while waiting in line, or even from the comfort of their own home.

Just like online banking, mobile banking applications usually offer a range of services that include:

- Viewing account balances and transaction history

- Transferring funds between accounts

- Setting up and managing bill payments

- Locking or unlocking debit or credit cards

- Locating nearby ATMs or branches

However, it’s important to note that mobile banking may have similar limitations as online banking. While it provides convenience and accessibility, customer support may be limited to online channels, such as chatbots or FAQs. Additionally, the availability of ATMs may be limited, especially for online-only banks that lack a physical branch network.

Despite these limitations, the advantages of mobile banking outweigh the drawbacks for many individuals. Its convenience, ease of use, and flexibility make it a popular choice for those seeking a convenient way to manage their finances.

| Features | Online Banking | Mobile Banking |

|---|---|---|

| Access | Through website on any internet-connected device | Through a mobile banking application on a smartphone or tablet |

| Convenience | Conduct transactions from anywhere with internet access | Perform banking tasks on the go |

| Customer Support | Online channels, limited in-person assistance | Online channels, limited in-person assistance |

| ATM Availability | Varying ATM networks, some may charge fees | Varying ATM networks, some may charge fees |

Pros and Cons of Traditional Banking

When it comes to managing finances, traditional banking offers a range of benefits and drawbacks. Let’s explore the pros and cons of traditional banking, including in-person banking and the variable service experience it provides.

Pros of Traditional Banking

-

Wide Range of Services: Traditional banks offer a comprehensive suite of financial services, including savings accounts, checking accounts, loans, mortgages, and investment options.

-

In-Person Customer Support: With traditional banking, you have the advantage of accessing in-person customer support. This enables you to discuss your financial needs, ask questions, and receive personalized assistance from bank staff.

-

Face-to-Face Relationship: By visiting a physical branch, you have the opportunity to build a face-to-face relationship with bank staff. This can create a sense of trust and familiarity, especially when dealing with important financial matters.

Cons of Traditional Banking

-

Physical Branch Visits: Traditional banking requires visiting a physical branch, which can be time-consuming, especially if the branch is not conveniently located.

-

Variable Service Experience: The service experience at traditional banks can vary between different branches. While some branches may provide exceptional service, others may fall short, resulting in a less satisfying customer experience.

-

Limited Convenience: In-person banking may not always be convenient, especially for individuals with busy schedules or mobility issues.

While traditional banking offers several advantages, such as access to a wide range of services and in-person customer support, it also has drawbacks, including the need for physical branch visits and varying service experiences. Consider your personal preferences and financial needs when deciding whether traditional banking is the right choice for you.

| Pros | Cons |

|---|---|

| Wide range of financial services | Physical branch visits |

| In-person customer support | Variable service experience |

| Opportunity to develop face-to-face relationship | Limited convenience |

Pros and Cons of Online Banking

Online banking offers a range of advantages and disadvantages for users. Let’s take a closer look at some of the pros and cons:

Pros:

- Convenience: Online banking provides a streamlined and convenient experience, allowing users to conduct transactions almost anywhere and anytime.

- Lower fees: Many online banks offer lower fees compared to traditional banks, saving users money on monthly maintenance fees, overdraft fees, and more.

- Higher interest rates: Online banks often provide higher interest rates on deposit accounts, enabling users to earn more on their savings.

Cons:

- Limited customer support: Customer support for online banks is typically limited to online channels, such as live chat or email. Users may have to wait for responses or may not receive personalized assistance.

- Fewer options for extra help: Online banks may have fewer options for users who require extra assistance, such as in-person help for complex transactions or financial advice.

- Smaller network of ATMs: Online banks may have a smaller network of ATMs available for users. This may result in fees for using out-of-network ATMs.

“Online banking offers convenience and lower fees, but it may lack the personal touch and extensive customer support options provided by traditional banks.”

To summarize, online banking provides a convenient and efficient way for users to manage their finances. It offers advantages such as lower fees and higher interest rates, but it’s important to consider the limitations, such as limited customer support and a smaller ATM network. Users should weigh the pros and cons and choose the banking option that best suits their needs.

The Similarities and Differences Between Online and Mobile Banking

Online banking and mobile banking are two popular ways to manage finances digitally, offering convenience and accessibility. While they share similarities in their goal of providing efficient financial services, there are also notable differences between the two.

Similarities

- Convenience: Both online banking and mobile banking eliminate the need for physical visits to banks or ATMs. They allow users to perform various banking transactions from the comfort of their own homes or on-the-go.

- Accessibility: Online banking and mobile banking provide 24/7 access to financial accounts. Users can check balances, transfer funds, pay bills, and perform other banking activities at any time and from any location with an internet connection.

Differences

While there are some similarities between online banking and mobile banking, there are also key differences that set them apart:

- Device Requirement: Online banking can be accessed through any internet-connected device, such as a computer or tablet. On the other hand, mobile banking specifically requires a smartphone or tablet with a dedicated mobile banking application.

- Features and Functionality: Online banking typically offers a broader range of features and functionality compared to mobile banking. Online banking platforms often provide more comprehensive account management tools and options for customization.

- User Experience: Mobile banking apps are specifically designed for smartphones and tablets, offering a mobile-optimized user experience. The interfaces are generally more intuitive and user-friendly compared to online banking websites.

- Security: Both online banking and mobile banking prioritize security measures to protect users’ financial information. However, mobile banking apps often utilize additional security features, such as biometric authentication (e.g., fingerprint or facial recognition), to enhance the security of the mobile banking experience.

Overall, both online banking and mobile banking offer convenient ways to manage finances digitally. Online banking caters to users who prefer accessing their accounts from various internet-connected devices, while mobile banking targets users who prefer the convenience of banking on-the-go through dedicated apps.

Advantages of Online Banks

When it comes to managing your finances, online banks offer a range of advantages that make them a smart choice for many individuals. Here are some of the key benefits of opting for an online bank:

Lower Fees

One of the major advantages of online banks is that they often have lower or no fees compared to traditional brick-and-mortar banks. With traditional banks, fees can quickly add up, eating into your hard-earned money. Online banks, on the other hand, have streamlined operations and lower overhead costs, allowing them to pass those savings onto their customers in the form of lower fees.

Better Interest Rates

Online banks are known for offering better interest rates on deposit accounts, giving you the opportunity to grow your savings faster. These higher interest rates can make a significant difference in the long run, allowing you to make the most of your hard-earned money.

Standard Bank Services

Despite being solely online, online banks still provide the standard bank services you would expect. This includes ATM access, so you can easily withdraw cash when needed. Additionally, online banks prioritize security measures to ensure your account and personal information are protected. Plus, they typically offer customer support through online channels or over the phone, ensuring you have assistance whenever you need it.

Overall, online banks provide a convenient and cost-effective way to manage your finances. With lower fees, better interest rates, and standard bank services, they offer a modern banking experience that meets the needs of today’s digital-savvy individuals.

Disadvantages of Online Banks

While online banking offers numerous benefits, there are also a few disadvantages that individuals should be aware of. These include:

Limited In-Person Help

One of the drawbacks of online banks is the limited access to in-person assistance. Unlike traditional banks with physical branches, online banks primarily rely on online or phone channels for customer interactions. This means that customers may not have the option to visit a physical location for face-to-face assistance or personalized guidance.

Cash Deposit Process

Another challenge with online banks is the cash deposit process. Since there are no physical branches, depositing cash becomes more complicated. Online banks typically provide alternative methods such as deposit-accepting ATMs or utilizing third-party services. This can be inconvenient for individuals who frequently deal with cash and prefer the simplicity of depositing it directly at a branch.

Fewer Account Options

While online banks offer a range of account options, some may have fewer choices compared to traditional banks. Customers may find that certain account types or specialized services are not available with online-only institutions. In such cases, individuals may need to open different types of accounts at different institutions to fulfill their specific financial needs.

Despite these disadvantages, many individuals still find online banks to be a convenient and efficient way to manage their finances. By weighing the pros and cons, individuals can make an informed decision about whether online banking is the right choice for them.

| Disadvantages of Online Banks | Impact |

|---|---|

| Limited in-person help | Customers may face challenges getting in-person assistance for personalized guidance or support. |

| Cash deposit process | Customers need to rely on alternative methods like deposit-accepting ATMs or third-party services for cash deposits, which can be more cumbersome. |

| Fewer account options | Online banks may not offer certain account types or specialized services, requiring customers to open accounts at different institutions. |

How to Get Started with Online Banking

Getting started with online banking is relatively simple. To begin, you will need to gather your account numbers and access your bank or credit union’s website. From there, you can follow these steps to register for online banking and start accessing your accounts:

- Visit your bank or credit union’s website

- Locate the “Register” or “Sign Up” button

- Click on the button and fill out the registration form

- Provide your personal information, including your name, address, and contact details

- Choose a username and password for your online banking account

- Select security questions and provide answers that you will remember

- Review and accept the terms and conditions

- Submit the registration form

Once you have successfully registered for online banking, you can log in to your account using your username and password. From there, you will have access to a variety of features and options, including:

- Viewing your account balances and transaction history

- Transferring funds between your accounts

- Paying bills online

- Setting up automatic payments and recurring transfers

- Managing your account preferences

- Contacting customer support for assistance

Online banking provides a convenient and secure way to manage your finances from the comfort of your own home or on the go. It offers flexibility and accessibility, allowing you to take control of your financial life with ease.

| Pros of Online Banking | Cons of Online Banking |

|---|---|

| Convenience – Access your accounts anytime, anywhere | Limited in-person help – Customer support may be limited to online channels |

| Lower fees – Online banks often have lower or no fees compared to traditional banks | Cash deposit process – Depositing cash may be more challenging with online banks |

| Better interest rates – Online banks may offer higher interest rates on deposit accounts | Fewer account options – Some online banks have a limited range of account options |

Conclusion

Online banking provides individuals with a convenient and secure way to manage their finances. Whether you choose to bank with a traditional institution that offers online services or opt for an online-only bank, you have a range of options to suit your preferences. It is crucial to consider the advantages and disadvantages of each type of online banking to make an informed decision that best aligns with your needs.

With online banking, you can enjoy the accessibility and convenience of managing your accounts anytime, anywhere. Whether you’re paying bills, transferring funds, or checking your balance, these tasks can be done with just a few clicks and taps. The ability to access your accounts online empowers you to take control of your financial life efficiently and effectively.

When it comes to security, online banking has made significant advancements to ensure the protection of your personal and financial information. Banks implement robust security measures such as encrypted connections, two-factor authentication, and real-time fraud monitoring to safeguard against unauthorized access and fraudulent activities. Additionally, reputable online banking platforms comply with industry standards and regulations to maintain the confidentiality and integrity of your data.

Ultimately, online banking offers you convenience, security, and options to manage your finances with ease. Whether you prefer the familiarity of a traditional bank or the flexibility of an online-only institution, online banking provides the tools and resources you need to stay on top of your financial goals.

FAQ

What is online banking?

Online banking refers to the ability for individuals to perform banking functions through a website, allowing them to manage their finances online.

What is traditional banking?

Traditional banking refers to brick-and-mortar banks with physical branch locations, providing a wide range of financial services and in-person customer support.

What is mobile banking?

Mobile banking is the use of a specific application on a smartphone or tablet device to access and manage banking services on the go.

What are the advantages of online banking?

Online banking offers convenience, accessibility, lower fees, and higher interest rates compared to traditional banking.

What are the disadvantages of online banking?

Online banking may have limited customer support, a smaller network of ATMs with possible fees, and restrictions on in-person assistance.

How is online banking different from mobile banking?

Online banking can be accessed through any internet-connected device, while mobile banking specifically requires a mobile app on a smartphone or tablet.

What services do online banks provide?

Online banks offer standard bank services such as ATM access, security measures, and customer support through online channels.

Can I deposit cash with an online bank?

Depositing cash with an online bank can be more challenging, often requiring alternative methods such as deposit-accepting ATMs or third-party services.

How do I get started with online banking?

To get started with online banking, you need to gather your account numbers and register for online access through your bank’s website, setting up a username and password.

Is online banking secure?

Online banking employs security measures such as encryption and multi-factor authentication to protect your financial information and transactions.

It's great that you talked about how business insurance can provide financial protection against unexpected events and help ensure the…

I like that you mentioned how business insurance is essential for protecting your bottom line and the long-term viability of…