How to Activate Your Metrobank Account for Online Banking

Activating your Metrobank account for online banking is a simple and convenient process that unlocks a world of financial management possibilities. Whether you want to check your account balance, transfer funds, or pay bills, activating your account will give you access to all these features and more. In this guide, I will walk you through the steps to activate your Metrobank account for online banking, ensuring that you can enjoy the benefits of Metrobank’s user-friendly online banking platform.

- Activating your Metrobank account for online banking allows you to conveniently manage your finances from anywhere.

- You can access account information, transfer funds, pay bills, and more through Metrobank’s online banking platform.

- Before activating your account, make sure to have your account details, valid identification, and registered mobile number or email address ready.

- You can activate your Metrobank account online, over the phone, or in person at a Metrobank branch.

- If you encounter any issues during the activation process, Metrobank provides customer support to assist you.

Why Activate Your Metrobank Account for Online Banking

Activating your Metrobank account for online banking comes with several benefits. By activating your account, you can enjoy the advantages of Metrobank’s online banking services, making it easier and more convenient to manage your finances. Let’s explore the benefits in detail:

- Convenient Financial Management: With online banking, you can access your account anytime, anywhere. Whether you need to check your balance, view transaction history, or monitor your savings, it’s all just a few clicks away.

- Access to Account Information: Get real-time updates on your account status, including deposits, withdrawals, and interest earned. No more waiting for monthly statements or visiting a branch.

- Effortless Fund Transfers: Easily transfer funds between your Metrobank accounts or to other accounts within the bank. Say goodbye to long queues and paperwork at the counter.

- Convenient Bill Payments: Pay your bills online through Metrobank’s online banking platform. Set up recurring payments or schedule one-time payments to save time and avoid late fees.

- Enhanced Security: Metrobank’s online banking platform uses the latest security measures to protect your account. You can have peace of mind knowing that your financial information is safeguarded.

“Online banking has revolutionized the way we manage our finances. With just a few simple steps to activate your Metrobank account, you can unlock a world of convenience and flexibility.”

By activating your Metrobank account for online banking, you can take advantage of these benefits and more. Experience the ease and efficiency of managing your finances from the comfort of your own home. Don’t miss out on the advantages that online banking has to offer.

| Benefits | Advantages |

|---|---|

| Convenient financial management | Manage your finances anytime, anywhere |

| Access to account information | Real-time updates on balance and transactions |

| Effortless fund transfers | Transfer funds between accounts with ease |

| Convenient bill payments | Pay bills online, set up recurring payments |

| Enhanced security | State-of-the-art security measures protect your account |

Requirements for Activating Your Metrobank Account

Before you can activate your Metrobank account for online banking, you’ll need to have a few key requirements in place. Ensuring you have these documents and information ready will help streamline the activation process and get you on your way to enjoying the benefits of online banking with Metrobank.

Gather the following requirements:

- Your Metrobank account details: This includes your account number and any other relevant account information. Make sure to have this information readily available.

- Valid identification: Metrobank requires valid identification to verify your identity and ensure the security of your account. Acceptable forms of identification may include a valid passport, driver’s license, or government-issued ID.

- Registered mobile number or email address: As part of the activation process, Metrobank may require a registered mobile number or email address. This is to ensure that you have a reliable contact method for important account notifications and updates.

Having these requirements ready beforehand will save you time and make the activation process smoother. Once you have them gathered, you can proceed with activating your Metrobank account for online banking.

“Before activating your Metrobank account, ensure you have all the necessary requirements in place. This will help speed up the activation process and allow you to access and manage your account online with ease.” – Metrobank Representative

How to Activate Your Metrobank Account Online

If you’re ready to start enjoying the convenience of Metrobank’s online banking services, activating your account is a simple process that can be done online. Follow the steps below to activate your Metrobank account and gain access to a wide range of banking features from the comfort of your own home.

- Log in to your Metrobank online banking portal: Visit Metrobank’s official website and locate the login section for online banking. Enter your account credentials, including your username and password, to access your account.

- Navigate to the account activation section: Once you’re logged in, look for the account activation section. This may be located under settings, account management, or a similar tab. Click on it to proceed with the activation process.

- Follow the prompts to activate your account: The activation process will vary slightly depending on your specific banking platform, but Metrobank will guide you through the necessary steps. Typically, you’ll be asked to verify your personal information and set up additional security measures, such as a secure PIN or two-factor authentication.

By completing these steps, you’ll successfully activate your Metrobank account for online banking. Now you’ll have the flexibility to manage your finances, check your account balance, transfer funds, pay bills, and more, all with just a few clicks.

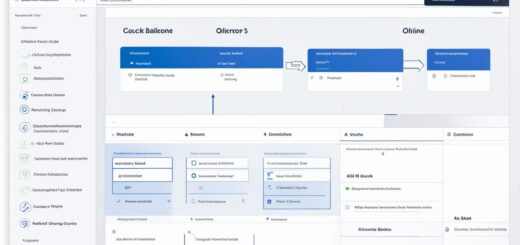

Screenshot of Metrobank Online Banking Portal

Take a look at the screenshot below to get a better idea of what Metrobank’s online banking portal looks like:

As you can see, Metrobank’s online banking interface is user-friendly and intuitive, making it easy for you to navigate and access the various features and services available.

Activating Your Metrobank Account Over the Phone

If you prefer a more convenient way to activate your Metrobank account for online banking, you have the option to do it over the phone. Metrobank’s customer service is available to assist you through the process. By following a few simple steps, you can activate your account without leaving your home.

-

Begin by calling Metrobank’s customer service hotline at [customer service number].

-

Provide the customer service representative with the necessary information to verify your identity and account details, such as your account number, full name, and registered mobile number or email address.

-

Listen carefully to the instructions provided by the customer service representative and follow them accordingly to activate your Metrobank account.

-

If there are any additional steps or security measures required, the customer service representative will guide you through the process.

Please note that it may be necessary to provide additional documentation or complete any outstanding requirements for account activation.

Activating your Metrobank account over the phone is a convenient option for those who prefer personal assistance. It ensures that you can activate your account and access online banking services without the need to visit a branch. Take advantage of this hassle-free method to start enjoying the benefits of Metrobank’s online banking at your convenience.

“Activating your Metrobank account over the phone is a simple and efficient process. With just a phone call, you can activate your account and gain access to a wide range of online banking services.” – Metrobank

Continue reading to learn more about activating your Metrobank account in person.

Activating Your Metrobank Account In Person

If you prefer a face-to-face approach to activate your Metrobank account for online banking, you can visit a Metrobank branch near you. This option allows you to interact with a bank representative who will guide you through the process and ensure a smooth activation.

To activate your account in person, make sure to bring your valid identification documents for verification purposes. This may include a government-issued ID such as a driver’s license or passport. Additionally, provide the necessary information required to activate your account, such as your account details and contact information.

“Visiting a Metrobank branch provides a personalized experience where you can have your questions answered and any concerns addressed by a knowledgeable bank representative.”

Once you arrive at the branch, approach a customer service representative or go to the designated account activation area. They will assist you in completing the necessary steps to activate your Metrobank account for online banking. The representative may ask for additional information or documentation to ensure the security and accuracy of the account activation process.

After verification and completion of the required procedures, your Metrobank account will be successfully activated for online banking. You can start enjoying the convenience and benefits of managing your finances online.

| Steps to Activate Your Metrobank Account In Person |

|---|

| Visit a Metrobank branch near you |

| Bring valid identification documents |

| Provide necessary information to bank representative |

| Complete required account activation procedures |

| Your Metrobank account is now activated for online banking |

Troubleshooting and Support for Metrobank Online Banking Activation

If you encounter any issues or have questions during the process of activating your Metrobank account for online banking, Metrobank provides customer support to assist you. Whether you’re facing technical difficulties or need guidance, their dedicated team is ready to help.

To receive immediate assistance, you can reach out to Metrobank’s customer service hotline at [phone number]. Their knowledgeable representatives are available to address your concerns and provide step-by-step guidance to resolve any activation issues.

If you prefer face-to-face support, you can also visit a Metrobank branch near you. A friendly bank representative will be happy to assist you in person and ensure a smooth activation process for your online banking account.

Remember, Metrobank is committed to providing excellent customer service and ensuring that you can access their online banking services seamlessly. Don’t hesitate to reach out for support when you need it. Activate your Metrobank account today and enjoy the convenience of online banking.

Common Issues Faced during Activation:

- Difficulty accessing the online banking portal

- Problems with account verification

- Invalid or expired activation codes

- Issues with password creation and reset

- Confusion regarding account information input

Never hesitate to seek assistance from Metrobank’s customer support. They have the knowledge and expertise to resolve any issues you may encounter during the account activation process.

Security Measures for Metrobank Online Banking

Ensuring the security of your Metrobank online banking is crucial to protect your valuable financial information. By following these essential security measures, you can safeguard your Metrobank account and have peace of mind while conducting your banking transactions.

Choose a Strong Password

When activating your Metrobank account, it is essential to choose a strong, unique password. Avoid using common passwords or personal information that can be easily guessed. Opt for a combination of uppercase and lowercase letters, numbers, and special characters to create a secure password that is difficult to crack.

Enable Two-Factor Authentication

Two-factor authentication adds an extra layer of security to your Metrobank account. By enabling this feature, you will receive a one-time verification code through your registered mobile number or email address, which you will need to enter along with your password during login. This additional step ensures that even if your password gets compromised, unauthorized access is prevented.

Regularly Update Your Personal Information

Keeping your personal information up to date is vital for security purposes. Ensure that your contact details, such as your mobile number and email address, are current in your Metrobank account. This allows Metrobank to communicate important notifications and alerts regarding your account status and any potential security concerns.

Be Cautious of Phishing Attempts

Phishing attempts are common methods used by cybercriminals to trick individuals into revealing sensitive information. Protect yourself by being vigilant and avoiding clicking on suspicious links or providing personal information in response to unsolicited emails, calls, or messages. Metrobank will never ask you to disclose sensitive information through unsecured channels.

“Always be cautious when sharing personal information online. Metrobank will never ask you to provide sensitive information, such as your account credentials, through email, calls, or text messages. Stay aware and report any suspicious communication to Metrobank immediately.”

Access Your Account Through Official Channels

To ensure the utmost security, only access your Metrobank account through official channels. Avoid using public or shared devices for online banking and refrain from accessing your account via unsecured Wi-Fi connections. Use Metrobank’s official website or mobile app to log in and perform your banking activities to minimize the risk of unauthorized access.

| Security Measure | Description |

|---|---|

| Choose a Strong Password | Create a unique and complex password |

| Enable Two-Factor Authentication | Add an extra layer of security with verification codes |

| Regularly Update Personal Information | Keep contact details current for notifications |

| Be Cautious of Phishing Attempts | Avoid clicking on suspicious links or sharing sensitive information |

| Access Account Through Official Channels | Use Metrobank’s official website or mobile app for secure access |

Conclusion

Activating your Metrobank account for online banking is a simple process that brings numerous benefits to managing your finances. By following the steps outlined in this guide, you can successfully activate your Metrobank account and access the convenient features of online banking.

With Metrobank’s online banking services, you can conveniently check your account balance, transfer funds, pay bills, and more, all from the comfort of your own home. This not only saves you time and effort but also allows you to have better control over your financial transactions.

As you activate your Metrobank account, remember to take advantage of the security measures provided. Choose a strong password, enable two-factor authentication, and keep your personal information up to date. These steps will help protect your account and ensure the safety of your online transactions.

FAQ

How do I activate my Metrobank account for online banking?

To activate your Metrobank account for online banking, you can either do it online, over the phone, or in person. Online activation involves logging in to your Metrobank online banking portal and following the prompts. Phone activation can be done by contacting Metrobank customer service and providing the necessary information. In-person activation requires visiting a Metrobank branch and providing your valid identification and account details to a bank representative.

What are the benefits of activating my Metrobank account for online banking?

Activating your Metrobank account for online banking offers several benefits. You can conveniently manage your finances, access account information, transfer funds, and pay bills from the comfort of your own home. Online banking provides ease of use and accessibility, allowing you to conduct banking transactions anytime and anywhere.

What are the requirements for activating my Metrobank account?

Before activating your Metrobank account for online banking, make sure you have the necessary requirements. This typically includes your account details, valid identification, and a registered mobile number or email address. Having these requirements ready will ensure a smooth activation process.

How do I activate my Metrobank account online?

To activate your Metrobank account online, log in to your Metrobank online banking portal using your account credentials. Navigate to the account activation section and follow the prompts to complete the activation process. Make sure to provide the required information accurately to ensure a successful activation.

Can I activate my Metrobank account for online banking over the phone?

Yes, you can activate your Metrobank account for online banking over the phone. Simply contact Metrobank’s customer service hotline and provide the necessary information. Follow the instructions provided by the customer service representative to activate your account successfully.

How can I activate my Metrobank account for online banking in person?

If you prefer a face-to-face approach, you can visit a Metrobank branch to activate your account for online banking. Bring your valid identification and provide the necessary information to a bank representative who will assist you in activating your account. They will guide you through the process and ensure all necessary steps are completed.

What should I do if I encounter any issues during the Metrobank account activation process?

If you encounter any issues or have questions while activating your Metrobank account for online banking, Metrobank provides customer support to assist you. You can reach out to their customer service hotline or visit a branch for further assistance. Their dedicated team will address your concerns and guide you through the process.

What security measures should I take when activating my Metrobank account for online banking?

Metrobank prioritizes the security of their online banking services. When activating your Metrobank account, ensure you choose a strong password, enable two-factor authentication if available, and regularly update your personal information. Additionally, be cautious of phishing attempts and only access your account through official channels to protect your account from unauthorized access.

What are the key takeaways from activating my Metrobank account for online banking?

By activating your Metrobank account for online banking, you unlock the convenience and accessibility of managing your finances from the comfort of your own home. Follow the activation steps carefully, provide the necessary requirements accurately, and make use of the security measures provided by Metrobank to ensure the safety of your online transactions.

It's great that you talked about how business insurance can provide financial protection against unexpected events and help ensure the…

I like that you mentioned how business insurance is essential for protecting your bottom line and the long-term viability of…