Maximize Gains with Crypto Tools Premier Guide

As an avid crypto investor, I’ve experienced the incredible highs and heart-wrenching lows of the crypto market. The volatility can be both thrilling and daunting, making it crucial to have the right strategies and tools in place. Throughout my journey, I’ve come to realize that one of the key secrets to success lies in leveraging the power of crypto tools.

These digital applications and software platforms have become an indispensable part of my investing arsenal. They have empowered me to navigate the complexities of the crypto asset market with confidence and precision. Whether it’s tracking market trends, analyzing data, or evaluating portfolio performance, these tools have revolutionized the way I approach crypto investing.

Today, I want to share with you a premier guide on crypto tools that will help you unlock the full potential of your investments. Whether you’re a seasoned trader or just starting, this guide will equip you with the knowledge and understanding you need to stay ahead in the ever-evolving world of cryptocurrencies.

So join me as we explore the best crypto tools available in 2024 and discover how they can maximize your gains, streamline your trading experience, and open doors to exciting market opportunities. Are you ready to take your crypto investments to the next level? Let’s dive in!

Key Takeaways:

- Crypto tools are essential for navigating the crypto asset market with confidence.

- These tools provide valuable services such as tracking market trends and analyzing crypto data.

- By leveraging the right tools, you can evaluate your portfolio performance and benefit from market opportunities.

- Stay tuned as we explore the best crypto tools in 2024 and their unique capabilities.

- With the right tools and knowledge, you can maximize your gains and unlock the full potential of your crypto investments.

What Are Crypto Tools?

Cryptocurrency tools are digital applications or software platforms designed to assist crypto investors in navigating the crypto asset market. They provide traders with a wealth of services and information, from tracking market trends and price movements to analyzing crypto data, providing predictive market insights, and tracking profitable digital wallets. These tools are available in different forms and have unique capabilities and features. Some popular tools for trading include CoinStats, Coinbase, and Crypto.com.

Benefits of Crypto Tools

“With the help of crypto tools, traders can gain a competitive edge in the market by making informed decisions and optimizing their trading strategies.”

Crypto tools offer several advantages to traders and investors in the cryptocurrency market:

- Market Tracking: These tools allow traders to monitor market trends and price movements in real-time, enabling them to make timely decisions.

- Data Analysis: Crypto tools provide comprehensive analysis of crypto data, enabling traders to identify patterns, correlations, and market insights.

- Portfolio Management: These tools help traders track their crypto investments, evaluate portfolio performance, and manage their digital assets effectively.

- Profit Maximization: By leveraging the features of crypto tools, traders can identify profitable opportunities, minimize risk, and optimize their trading strategies.

With the growing complexity and volatility of the cryptocurrency market, cryptocurrency tools have become essential for traders and investors. They empower individuals to navigate the market with confidence, increase their efficiency, and maximize their potential gains.

Comparing Popular Crypto Tools

| Tool | Key Features |

|---|---|

| CoinStats | Real-time price tracking, portfolio management, transaction tracking, exchange integrations, alerts and notifications. |

| Coinbase | Secure storage of crypto assets, trading platform, mobile app, cryptocurrency wallet, recurring buys. |

| Crypto.com | Cryptocurrency trading, crypto debit card, staking, lending, earn interest on deposits. |

Best Crypto Tools in 2024

There are numerous premier crypto tools available in 2024 that cater to the diverse needs of traders and investors. These cutting-edge applications offer a range of functionalities, enabling users to secure, borrow, spend, and earn cryptocurrencies efficiently and cost-effectively. Here are some of the top crypto tools:

| Name | Description |

|---|---|

| CoinStats | A comprehensive portfolio tracker and trading platform that provides real-time market data, price alerts, and portfolio analysis. CoinStats offers a user-friendly interface and supports integration with multiple exchanges. |

| Coinbase | A leading cryptocurrency exchange and wallet provider that allows users to buy, sell, and store various cryptocurrencies. Coinbase offers a secure platform, intuitive interface, and supports seamless fiat-to-crypto transactions. |

| Crypto.com | A versatile platform that offers a range of crypto services, including a crypto wallet, crypto debit card, and an integrated exchange. Crypto.com provides users with convenient ways to manage their crypto assets and perform everyday transactions. |

These premier crypto tools empower users with comprehensive market insights, real-time data, and intuitive interfaces, enabling them to make informed trading decisions and optimize their crypto investments.

Combine the power of these tools with the right strategies, and you’ll be well-equipped to navigate the dynamic world of cryptocurrencies.

Importance of Using These Tools

By leveraging the top crypto tools, traders can maximize their trading efficiencies and make informed decisions. These powerful digital applications and platforms offer a range of features that enhance the overall trading experience. Let’s take a closer look at why these tools are essential for successful crypto trading.

Consolidated Outlook and Portfolio Evaluation

One of the key advantages of using crypto tools is the ability to track all your investments in one place. These tools provide a consolidated outlook of your holdings, allowing you to monitor your portfolio performance and make informed decisions based on real-time data. With a comprehensive overview, you can easily identify trends, analyze historical performance, and adapt your strategies accordingly.

Advanced Charting and Real-Time Market Data

Crypto tools offer advanced charting tools and real-time market data, enabling traders to visualize price movements, identify patterns, and execute trades with precision. These tools provide detailed charts, technical indicators, and customizable trading interfaces that cater to individual preferences. By accessing real-time market data, traders can stay updated on the latest market trends and identify potential opportunities for profitable trades.

Integration with Exchanges and Personalized Trading Interfaces

Many crypto tools integrate seamlessly with popular exchanges, allowing traders to execute trades directly within the platform. This integration streamlines the trading process and eliminates the need to switch between different platforms. Additionally, these tools often offer personalized trading interfaces, allowing traders to customize their dashboards and optimize their trading experience based on their specific needs and preferences.

Overall, leveraging crypto tools not only provides traders with a consolidated overview of their investments but also enhances their trading efficiencies. With advanced charting tools, real-time market data, integration with exchanges, and personalized trading interfaces, these tools empower traders to make informed decisions and capitalize on market opportunities.

Different Kinds of Tools

When it comes to navigating the world of cryptocurrencies, having the right tools at your disposal can make all the difference. There are various types of crypto tools available to traders and investors, each serving a different purpose and providing unique functionalities. These tools are designed to streamline the crypto trading process, enhance portfolio management, and facilitate efficient decision-making. Let’s take a closer look at some of the key categories of crypto tools:

1. Crypto Portfolio Trackers

A crypto portfolio tracker is a powerful tool that allows traders to monitor and manage their crypto holdings in one centralized platform. These tools provide real-time updates on portfolio performance, including detailed information on asset allocation, profit/loss analysis, and historical data. Popular crypto portfolio trackers include CoinStats, Blockfolio, and Delta.

2. Crypto Trading Tools

Crypto trading tools are specifically designed to assist traders in executing trades and optimizing their trading strategies. These tools offer features such as advanced charting tools, real-time market data, order book analysis, and trade execution across multiple exchanges. Some well-known crypto trading tools include TradingView, Binance, and eToro.

3. Crypto Tax Tools

As cryptocurrencies become more mainstream, it’s important for traders to stay compliant with tax regulations. Crypto tax tools help individuals and businesses calculate their crypto tax liabilities, generate tax reports, and ensure accurate reporting to tax authorities. Examples of popular crypto tax tools are CoinTracking, CryptoTrader.Tax, and TokenTax.

4. Crypto Charting Tools

Crypto charting tools provide traders with in-depth market analysis through the use of advanced technical indicators and charting capabilities. These tools enable traders to analyze price patterns, identify trends, and make informed trading decisions. Some widely used crypto charting tools include TradingView, Coinigy, and CryptoCompare.

5. Crypto Research Tools

Crypto research tools offer comprehensive data and insights to help traders stay informed about the latest market trends and developments. These tools provide access to news articles, price analysis, market sentiment indicators, and research reports from trusted sources. Notable crypto research tools include CoinMarketCal, CoinGecko, and CoinDesk.

6. Crypto Analysis Tools

Crypto analysis tools utilize advanced algorithms and data analytics to generate predictive insights and forecast market movements. These tools assist traders in identifying patterns, predicting price fluctuations, and making data-driven investment decisions. Examples of crypto analysis tools include CryptoSlate, Santiment, and CoinPredictor.

7. Tools for Businesses

In addition to tools designed for individual traders, there are also crypto tools tailored for businesses operating in the crypto space. These tools enable businesses to accept cryptocurrencies as payment, manage payroll in digital assets, track business expenses, and streamline accounting processes. Some prominent tools for businesses include BitPay, CoinGate, and QuickBooks Crypto.

Each category of crypto tools plays a crucial role in the success of traders and investors in the crypto market. By leveraging the right combination of these tools, individuals can enhance their trading strategies, effectively manage their portfolios, and stay ahead in the dynamic world of cryptocurrencies.

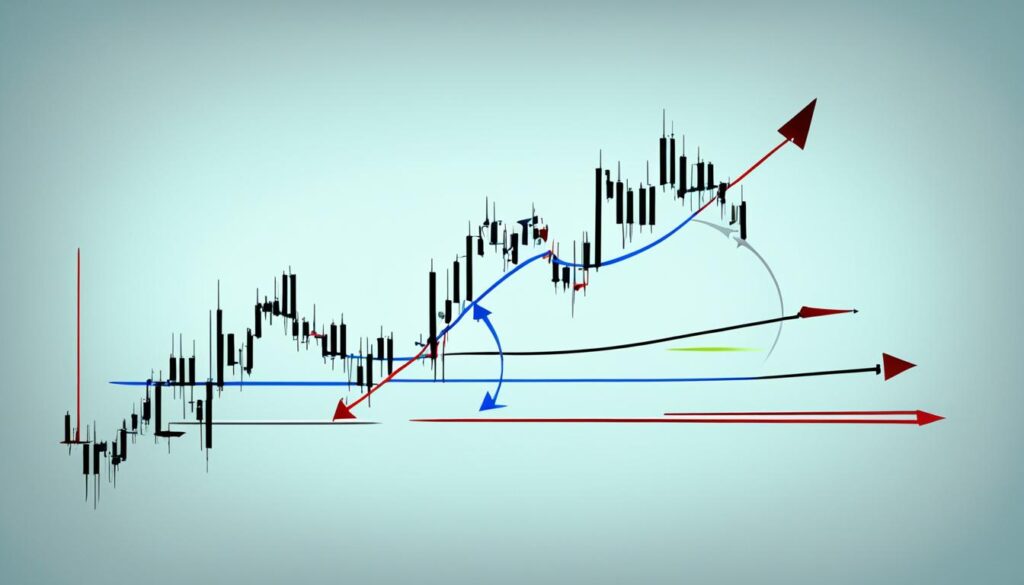

Understanding Breakout Trading

Breakout trading is a market entry strategy that capitalizes on significant shifts in asset prices by identifying and exploiting key support and resistance levels. When the market breaks through these crucial levels, it signals potential opportunities for traders to enter or exit positions.

Traders who engage in breakout trading aim to accurately identify support and resistance levels and strategically time their market entry. Support levels act as price floors where buying activity is expected to increase, while resistance levels are price ceilings where selling activity is expected to hinder further price increases.

By accurately pinpointing these support and resistance levels, traders can anticipate potential breakouts and position themselves for profitable trades. The success of breakout trading relies on a meticulous approach and sound market analysis to minimize risk and maximize returns.

Key Elements of Breakout Trading

- Identifying Support and Resistance Levels: Traders use technical analysis tools, such as chart patterns and indicators, to identify key support and resistance levels. These levels serve as crucial reference points for breakout trading strategies.

- Timing Market Entry: Traders strategically time their entry into the market based on the breakout of support or resistance levels. This requires monitoring price movements and market conditions to identify optimal entry points.

- Implementing Risk Management: Breakout trading carries inherent risks, and traders must implement effective risk management strategies. This includes setting stop-loss orders to limit potential losses and managing position sizes based on risk-reward ratios.

Benefits and Considerations of Breakout Trading

Breakout trading offers several potential benefits for traders:

- Opportunity for capturing substantial price movements when assets break out of support or resistance levels.

- Potential to generate significant profits within short timeframes, particularly in volatile markets.

- Ability to identify potential trend reversals and capitalize on new market trends.

However, it is important to consider the following considerations when engaging in breakout trading:

- False breakouts can occur, where the market briefly breaks through a support or resistance level but quickly reverses. Traders must be cautious and rely on confirmatory signals before entering a trade.

- Market conditions can be unpredictable, and breakout trading strategies may not always yield favorable results. Traders must continuously monitor market conditions and adapt their strategies accordingly.

Breakout trading requires a thorough understanding of support and resistance levels and effective risk management. Traders who can accurately identify and respond to breakout opportunities may potentially capitalize on significant price movements and achieve profitable trades.

Mastering the Art of Trading: Understanding Support and Resistance Levels

Support and resistance levels play a crucial role in breakout trading. These levels provide valuable insights into price movements, help identify potential breakout opportunities, and shape trading strategies. Let’s delve deeper into the significance of support and resistance levels in breakout trading.

Support Levels: Anticipating Buying Activity

Support levels act as price benchmarks where buying activity is anticipated. These levels represent a point in the market where demand for a particular asset is strong, preventing prices from further declining. Traders often take note of support levels to determine potential entry points for a breakout trade. By recognizing key support levels, traders can strategically time their market entry and capitalize on price movements.

Resistance Levels: Identifying Selling Activity

Resistance levels, on the other hand, indicate price tiers where selling activity is expected to hinder further price increases. These levels represent areas in the market where supply outweighs demand, creating a barrier for prices to rise. Traders closely monitor resistance levels to identify potential selling opportunities or price reversals. By understanding resistance levels, traders can make informed decisions on when to exit a breakout trade.

In breakout trading, it’s essential to recognize and understand support and resistance levels. These levels act as key indicators, allowing traders to gauge market sentiment and identify potential breakout opportunities.

By analyzing historical price data, chart patterns, and market trends, traders can identify significant support and resistance levels. These levels help validate breakout trading strategies and enhance market entry timing. Traders often combine support and resistance levels with other technical analysis tools, such as trend lines, moving averages, and oscillators, to gain a comprehensive understanding of the market.

Now that we have a good understanding of support and resistance levels, let’s explore the dynamics of a market breakout and the strategies employed by breakout traders in the next section.

Understanding the Dynamics of a Market Breakout

A market breakout is one of the most anticipated events in trading when traders identify the potential breach of support or resistance levels. Breakout traders employ specific strategies to identify and respond to these breakouts, utilizing chart patterns and indicators to predict market movements and capitalize on price changes. In the highly volatile crypto market, breakout trading can be an effective strategy for traders looking to maximize their profits.

“Breakout trading is a key strategy that allows traders to take advantage of significant shifts in asset prices. By accurately pinpointing support and resistance levels and strategically timing market entry, traders can anticipate and capitalize on breakouts.”

Breakout traders carefully analyze historical price data, patterns, and market trends to identify potential breakouts. They often use technical analysis indicators such as moving averages, Bollinger Bands, and volume analysis to validate breakout signals. By combining these tools with proper risk management techniques, breakout traders aim to minimize losses and optimize their trading performance.

Successful breakout traders understand that market breakouts can be short-lived and highly volatile. Therefore, they adopt different breakout strategies, including breakout pullback, breakout continuation, and breakout reversal, to adapt to various market conditions. These strategies allow traders to enter the market at the right time and capture the momentum generated by the breakout event.

Regardless of the chosen breakout strategy, traders need to develop a deep understanding of support and resistance levels, as they serve as the foundation for breakout trading. Support levels act as price floors that represent areas where buying activity is expected to emerge. Resistance levels, on the other hand, act as price ceilings where selling activity is likely to intervene.

By studying price action and observing the reactions of traders around these support and resistance levels, breakout traders gain valuable insights into market sentiment and can make informed trading decisions.

Benefits of Breakout Trading

Breakout trading offers several advantages for traders in the crypto market:

- Profit potential: Breakouts can result in significant price movements, providing traders with the opportunity to capture substantial gains.

- Clear entry and exit levels: Breakout trading allows traders to establish clear entry and exit points based on the breach of support or resistance levels.

- Reduced risk: Breakout traders can set stop-loss orders near the breakout levels, limiting potential losses in case the breakout fails.

Traders who specialize in breakout strategies understand the importance of thorough analysis and proper risk management. By mastering the dynamics of market breakouts, traders can position themselves advantageously and take advantage of profitable trading opportunities.

Moralis Money: The Best Tool for Crypto Day Trading

When it comes to crypto day trading, having the right tools can make all the difference in maximizing your profits and staying ahead of the market. That’s where Moralis Money comes in. This premier tool is designed specifically for crypto day traders, providing them with the essential features they need to succeed.

One of the key advantages of Moralis Money is its ability to leverage on-chain data to provide real-time market updates. By analyzing blockchain data, this tool gives traders valuable insights into market trends, price movements, and potential trading opportunities. With up-to-the-minute information, traders can make informed decisions and stay one step ahead of the competition.

Moralis Money offers a range of features that are tailored to the needs of crypto day traders. Let’s take a closer look at some of the key features:

- Token Explorer: Explore the vast world of cryptocurrencies with Moralis Money’s Token Explorer. This feature allows you to dive deep into the details of different tokens, including their market cap, trading volume, and historical price charts. With this information at your fingertips, you can identify promising altcoin gems and make profitable trading decisions.

- Token Alerts: Stay on top of the market with Moralis Money’s Token Alerts feature. Set up personalized alerts for specific tokens and be notified when they reach your desired price levels. Whether you’re looking to buy the dip or take profits, this feature ensures you never miss out on important trading opportunities.

- Token Shield: Protect your investments with Moralis Money’s Token Shield feature. This tool allows you to set stop-loss and take-profit orders to automate your trading strategy. By defining these thresholds, you can minimize risk and maximize potential gains, even when you’re away from your trading desk.

Moralis Money is designed to address the challenges that crypto day traders face, such as the fear of missing out and time limitations. With its cutting-edge features and real-time market updates, Moralis Money empowers traders to make informed decisions and maximize their profits in the fast-paced world of crypto day trading.

Conclusion

Crypto day trading can be a highly profitable endeavor when equipped with the right tools and strategies. For traders seeking to maximize their gains and make informed decisions, Moralis Money stands out as the best tool in the market. With its innovative features and real-time on-chain data, Moralis Money provides valuable insights and empowers traders in the fast-paced world of crypto day trading.

By utilizing Moralis Money, traders can access real-time market updates, track altcoin gems, and stay ahead of market trends. The comprehensive features, such as Token Explorer, Token Alerts, and Token Shield, enable traders to overcome challenges like the fear of missing out and time constraints.

Furthermore, Moralis Money offers an exciting opportunity for passive crypto income through its affiliate program. Traders can not only enhance their own trading activities but also earn additional rewards by referring others to this exceptional tool.

With the right knowledge and utilizing Moralis Money as the ultimate tool for crypto day trading, traders can navigate the crypto market confidently. By capitalizing on short-term price movements and leveraging the power of Moralis Money, traders can achieve their financial goals and enjoy success in the dynamic world of crypto day trading.

FAQ

How can crypto tools help maximize gains?

Crypto tools are designed to assist traders in navigating the crypto asset market by providing services such as tracking market trends, analyzing crypto data, and offering predictive market insights. By leveraging these tools, traders can effectively track investments, evaluate portfolio performance, and benefit from market opportunities, ultimately maximizing gains.

What are crypto tools?

Crypto tools are digital applications or software platforms designed to assist crypto investors in navigating the crypto asset market. They provide traders with services such as tracking market trends, analyzing crypto data, and offering predictive market insights.

What are the best crypto tools in 2024?

Some of the top crypto tools in 2024 include CoinStats, Coinbase, and Crypto.com. These tools offer advanced charting, real-time market data, integration with exchanges, and personalized trading interfaces that enhance trading strategies and decision-making.

Why is it important to use crypto tools?

Using crypto tools enhances trading efficiencies by providing a consolidated outlook of holdings, real-time market data, and advanced charting tools. These tools enable traders to make informed decisions, track investments, and capitalize on market opportunities.

What are the different kinds of crypto tools?

There are different kinds of crypto tools available, including crypto portfolio trackers, crypto trading tools, crypto tax tools, crypto charting tools, crypto research tools, and tools for businesses. These tools cater to different needs and provide various functionalities to assist traders and investors.

What is breakout trading?

Breakout trading is a market entry strategy that harnesses significant shifts in asset prices by accurately pinpointing support and resistance levels. Traders strategically time their market entry to capitalize on potential breakouts, which carry inherent risks but can be navigated effectively with a meticulous approach and sound market analysis.

How do support and resistance levels impact breakout trading?

Support and resistance levels are crucial in breakout trading as traders use them to interpret price movements, identify potential breakout opportunities, and shape trading strategies. Support levels represent price benchmarks where buying activity is anticipated, while resistance levels indicate price tiers where selling activity is expected to hinder further price increases.

What is a market breakout?

A market breakout occurs when traders anticipate the breach of support or resistance levels. Breakout traders employ strategies to identify and respond to potential breakouts, relying on chart patterns and indicators to predict market movements and capitalize on price changes. Breakout trading can be an effective strategy in the highly volatile crypto market.

What is Moralis Money and why is it the best tool for crypto day trading?

Moralis Money is a premier tool for crypto day trading that leverages on-chain data to provide real-time market updates. It offers features like Token Explorer, Token Alerts, and Token Shield, which provide valuable insights into potential altcoin gems and help traders overcome the challenges of day trading, such as the fear of missing out and time limitations.

How can leveraging the right tools maximize gains in crypto day trading?

By using the best crypto tools like Moralis Money, traders can maximize gains in crypto day trading. These tools provide valuable market insights, real-time market updates, and assist in informed trading decisions. Additionally, the Moralis Money affiliate program offers opportunities for passive crypto income.

It's great that you talked about how business insurance can provide financial protection against unexpected events and help ensure the…

I like that you mentioned how business insurance is essential for protecting your bottom line and the long-term viability of…