Spot Insurance: Your On-Demand Policy Guide

Are you tired of going through the hassle of traditional insurance processes? Look no further! Spot insurance is here to revolutionize your coverage experience. With spot insurance, you have the flexibility to customize your policy on-demand, saving you time and money. Whether you need auto insurance or home insurance, spot insurance has got you covered.

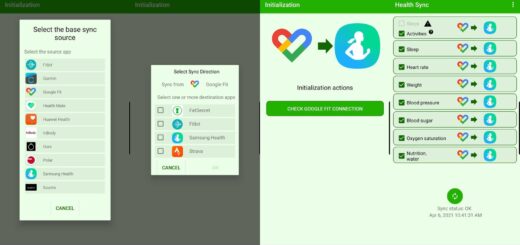

Gone are the days of lengthy interactions with insurance representatives. Spot insurance allows you to get coverage quickly and easily through a mobile or web application. Say goodbye to paperwork and hello to instant access and control over your policy terms. It’s insurance made simple, designed to fit your specific needs.

Key Takeaways:

- Spot insurance offers customizable coverage on-demand for various needs.

- It provides convenience, control, and instant access to coverage.

- Spot insurance saves you time and money by eliminating the need for lengthy interactions with insurance representatives.

- The on-demand insurance market is rapidly growing, with an estimated 30% increase by 2026.

- Several on-demand insurance providers, such as Metromile, Thimble, and Spot, already offer spot insurance coverage.

What is Spot Insurance?

Spot insurance is a type of on-demand insurance that provides flexible coverage and a customizable policy experience. As a policyholder, you have the ability to tailor your coverage according to your specific needs and preferences. Whether you want to change policy terms, add or remove coverages, or make other adjustments, spot insurance allows you to do so easily through a mobile or web application.

One of the key benefits of spot insurance is the ability to have instant access to coverage. With traditional insurance, you often have to go through a lengthy process of submitting paperwork and waiting for approval. However, with spot insurance, you can apply and turn on coverage in just a few minutes, making it extremely convenient and efficient.

Another advantage of spot insurance is the potential for expense savings. Since the application process is handled digitally, there are lower commissions and acquisition costs involved. This could result in lower premiums and more affordable coverage options for policyholders.

Spot insurance is available in various lines of business, including personal auto, commercial liability, and accidental injury coverage. This means that whether you need coverage for your car, business, or protection against unexpected accidents, spot insurance can offer a flexible solution tailored to your specific needs.

The Benefits of Spot Insurance

- Flexibility to customize coverage

- Instant access to coverage

- Potential expense savings

Spot insurance empowers policyholders by giving them control over their coverage and the convenience of quick access. With its customizable policy options and flexibility, spot insurance is revolutionizing the insurance industry, offering a convenient and efficient way to protect what matters most to you.

Spot insurance gives policyholders the power to tailor their coverage, providing a level of control and convenience that was previously unheard of in the insurance industry.

With spot insurance, gone are the days of one-size-fits-all policies. Instead, you have the freedom to customize your coverage to match your unique needs and circumstances. Whether you need additional protection for a specific event or want to save on premiums by adjusting your coverage, spot insurance offers the flexibility you need.

Advantages of Spot Insurance

Spot insurance offers several advantages over traditional insurance. One of the main advantages is convenience, as the application process is simplified through a mobile or web application with an easy-to-understand interface. Policyholders can customize their coverage, add or remove coverages, and make changes without having to contact an insurance representative. This level of control gives policyholders more flexibility and ensures that they only pay for the coverage they need.

Spot insurance also provides instant access to coverage, allowing policyholders to apply and turn on coverage in minutes. This type of insurance often has lower premiums compared to traditional insurance, as it eliminates the need for extensive paperwork and reduces acquisition costs.

| Advantages of Spot Insurance | |

|---|---|

| Convenience | A simplified application process through a mobile or web app |

| Customizable coverage and policy adjustments without contacting an insurance representative | |

| Flexibility to pay for only the coverage needed | |

| Control | Instant access to coverage, with the ability to apply and turn on coverage in minutes |

| Lower Premiums | |

| Reduced paperwork and acquisition costs |

On-Demand Insurance Market Growth

The on-demand insurance market is experiencing rapid growth, fueled by the increasing demand for more convenient and flexible insurance options. According to market projections, the on-demand insurance market is expected to expand by nearly 30% by 2026, driven by the shift towards customer-centric insurance solutions.

Consumers are seeking insurance options that offer a streamlined application process, instant access to coverage, and the ability to customize policies based on their individual needs. On-demand insurance meets these demands, providing a user-friendly experience and empowering policyholders to tailor their coverage to fit their unique requirements.

This upward trend in the on-demand insurance market is likely to continue in the future as consumers become more accustomed to the benefits and flexibility of this insurance model. Insurance providers that embrace this shift towards on-demand insurance will gain a competitive advantage in the market and meet the evolving needs of the digitally-savvy consumer.

Future Trends

- Rise of specialized on-demand insurance: As the on-demand insurance market grows, we can expect to see more specialized offerings catering to specific industries or niche markets. This trend will allow businesses and individuals to obtain coverage that is tailored to their unique needs and provides more comprehensive protection.

- Integration of emerging technologies: The future of on-demand insurance will likely involve the integration of emerging technologies such as artificial intelligence and blockchain. These technologies can streamline the claims process, enhance fraud detection, and enable faster policy issuance, further enhancing the efficiency and convenience of on-demand insurance.

- Expansion to new markets: With the rapid growth of on-demand insurance, we can anticipate its expansion into new markets and geographies. This expansion will provide greater accessibility to insurance products and services, ensuring that individuals and businesses around the world can benefit from on-demand coverage.

As the on-demand insurance market continues to evolve and grow, it is essential for insurance providers to stay ahead of these trends and offer innovative solutions that meet the changing needs of consumers. By embracing flexibility, customization, and convenience, on-demand insurance providers can position themselves for success in the future.

Key Statistics on On-Demand Insurance Market Growth

| Year | Market Growth |

|---|---|

| 2021 | 20% |

| 2022 | 25% |

| 2023 | 28% |

| 2024 | 32% |

| 2025 | 27% |

| 2026 | 30% |

Spot Insurance Providers

When it comes to on-demand insurance providers, there are several options to choose from. Here are three prominent companies offering spot insurance coverage:

“Metromile” offers personal auto coverage with an innovative pricing structure. They charge a low monthly rate combined with a per-mile charge tracked using telematics. This unique approach allows policyholders to pay for insurance based on their actual usage, making it a cost-effective option for those who drive less frequently.

“Thimble” specializes in providing commercial general liability and miscellaneous professional liability coverage on a short-term basis. Their mobile and web application allows policyholders to easily manage their coverage, with features such as the ability to pause and reactivate coverage. This flexibility makes Thimble an ideal choice for businesses with dynamic insurance needs.

“Spot” offers accidental injury coverage on a subscription basis. This type of coverage can serve as supplemental insurance or act as primary coverage for individuals without comprehensive healthcare coverage. With Spot, policyholders can have peace of mind knowing they have protection in case of an unexpected accident.

These providers are just a few examples of the growing market for spot insurance. Each company offers unique features and benefits, catering to different insurance needs and preferences.

| Insurance Provider | Insurance Coverage | Special Features |

|---|---|---|

| Metromile | Personal auto coverage | Low monthly rate + per-mile charge based on usage |

| Thimble | Commercial general liability and miscellaneous professional liability coverage | Short-term coverage with pause and reactivate options |

| Spot | Accidental injury coverage | Subscription-based coverage for supplemental or primary protection |

Challenges of On-Demand Insurance

While on-demand insurance offers many advantages, there are also some challenges to consider. One challenge is the risk of moral hazard, as it can be difficult to verify the accuracy of applicant responses during the application process. Insurers need to develop better verification and auditing systems to ensure that risks are priced appropriately.

Another challenge is the potential for fraudulent claims, as policyholders can purchase coverage after an actual loss or damage has occurred and make fraudulent claims. This presents a challenge for insurance providers in assessing the validity of claims and protecting against attempts to defraud the system.

Additionally, on-demand policies often have concentrated exposure, as coverage is purchased or turned on for a specific period. This concentrated risk requires insurers to adequately set rates to cover potential losses within the defined coverage period.

Moral Hazard and Verification

The risk of moral hazard arises due to the difficulty in accurately assessing an applicant’s honesty and intentions during the application process. Insurers rely on the information provided by applicants to determine the appropriate coverage and premium rates. However, without thorough verification, there is a risk that inaccurate or misleading information may result in underpricing the risk, leading to potential losses for the insurer.

Fraudulent Claims and Protection

On-demand insurance policies that allow coverage to be purchased after a loss has occurred present an increased risk of fraudulent claims. Policyholders may exploit this feature by intentionally causing damage or loss and then making a claim for compensation. Insurance providers must implement robust fraud detection and prevention measures to mitigate this risk and protect against fraudulent claims.

Concentrated Exposure and Pricing

With on-demand policies, coverage is typically purchased or turned on for a specific period, resulting in concentrated exposure for the insurer. This means that the risk of a loss occurring within the coverage period is higher compared to traditional insurance policies with continuous coverage. To adequately cover this concentrated risk, insurers need to set rates that reflect the increased probability of claims within the defined coverage period.

Regulatory Considerations for On-Demand Insurance

On-demand insurance programs often face regulatory difficulties due to their unique rating, form, and program features. State insurance departments may have different requirements for reviewing and approving on-demand insurance products. For example, short-term on-demand programs may require leveraged rating factors for concentrated short-term coverages, while mobile and web applications may require snapshots of each possible screen. These regulatory considerations can create a more challenging path to approval for on-demand insurance providers.

Regulatory Challenges

When it comes to on-demand insurance, regulatory hurdles can pose significant challenges for insurance providers. The dynamic and customizable nature of on-demand insurance programs may not fit neatly within traditional regulatory frameworks. This can lead to delays and difficulties in securing the necessary approvals to offer these innovative insurance products.

One regulatory difficulty that on-demand insurance faces is the need to account for unique program features. Traditional insurance products are designed with standard coverage terms and conditions, whereas on-demand insurance allows policyholders to customize their coverage on an as-needed basis. These unique program features require careful evaluation and consideration from regulatory authorities to ensure that policyholders are adequately protected and insurance companies are complying with applicable regulations.

State Insurance Department Requirements

State insurance departments play a crucial role in regulating the insurance industry and ensuring consumer protection. However, navigating the complex web of requirements from different state insurance departments can be a daunting task for on-demand insurance providers.

For example, some state insurance departments may require on-demand insurance providers to implement leveraged rating factors for short-term coverages. This means that pricing and rating structures must account for the concentrated risk associated with short-term policies, allowing for accurate and fair premiums.

In addition, state insurance departments may also require on-demand insurance providers with mobile and web applications to provide snapshots of each possible screen. This ensures that the application process, policy information, and terms are transparent and easily accessible to policyholders.

Overcoming Regulatory Challenges

While regulatory difficulties exist, on-demand insurance providers can navigate these challenges by establishing strong relationships with state insurance departments and proactively addressing regulatory concerns.

Insurance companies should engage in open and transparent communication with regulatory authorities, providing comprehensive documentation and explanations of their on-demand insurance programs. It is important to demonstrate how these programs adhere to existing regulations and consumer protection standards, while also highlighting the unique benefits they bring to policyholders.

Furthermore, collaborating with industry associations and participating in regulatory discussions can help shape new regulations and guidelines that address the specific needs of on-demand insurance. By actively engaging with regulators, insurance providers can contribute to the development of a regulatory environment that promotes innovation while protecting the interests of policyholders.

Overall, while regulatory considerations present challenges for on-demand insurance, with proactive efforts and collaboration, the industry can find ways to overcome these hurdles and continue to offer innovative and customized insurance solutions to consumers.

Benefits of Spot Insurance for Businesses

Spot insurance provides numerous benefits for businesses, offering additional revenue streams and enhancing customer care. By incorporating spot insurance into their offerings, businesses can tap into unrealized revenue streams by providing flexible and customizable coverage options to their customers. This not only adds value and security for customers but also mitigates the risk of potential lawsuits and customer dissatisfaction.

One of the major advantages of spot insurance is its ability to simplify the insurance process for customers. With spot insurance, businesses can provide 1:1 guidance from a dedicated customer care advocate, eliminating the legwork typically associated with insurance. This personalized support ensures that businesses and their customers have the necessary guidance and assistance throughout the insurance process, enhancing overall customer satisfaction.

Additionally, spot insurance enables businesses to leverage shared data to gain valuable insights into their customers and their purchasing behavior. By understanding their customers better, businesses can make informed decisions, tailor their offerings, and provide targeted marketing campaigns to meet customer needs effectively. This data-driven approach allows businesses to continue growing and adapting to the evolving needs of their customers.

In conclusion, spot insurance offers significant benefits to businesses. It not only opens up new revenue streams but also enhances customer care through personalized guidance and leverage of shared data. By incorporating spot insurance into their business strategies, businesses can stay competitive, provide comprehensive coverage options, and meet the ever-changing needs of their customers.

Conclusion

Spot insurance offers a flexible and customizable coverage option for policyholders, allowing them to tailor their policies on-demand. This innovative approach to insurance brings numerous advantages over traditional policies, including convenience, control, instant access, and expense savings.

The on-demand insurance market is experiencing significant growth, with a projected increase of nearly 30% by 2026. This growth is driven by consumer demand for more convenient and flexible insurance options. Spot insurance providers, such as Metromile, Thimble, and Spot, are already offering spot insurance coverage in various lines of business, catering to the evolving needs of policyholders.

While there may be challenges and regulatory considerations to navigate, spot insurance presents unique benefits for businesses as well. It opens new revenue streams and enhances customer care by offering flexible and customizable coverage options. By simplifying the insurance process and providing personalized guidance, spot insurance helps businesses mitigate risk, enhance customer satisfaction, and gain insights into customer behavior.

With the increasing demand for flexible and on-demand insurance options, spot insurance proves to be a valuable and convenient choice for policyholders. Its ability to adapt to changing needs, coupled with its convenience and cost savings, makes spot insurance an ideal solution in the dynamic insurance landscape.

FAQ

What is spot insurance?

Spot insurance is a flexible and customizable coverage option that allows policyholders to tailor their policies on-demand for various needs, including auto and home insurance.

What are the advantages of spot insurance?

Spot insurance offers convenience, control, instant access, and expense savings. Policyholders can customize their coverage, make changes easily, and only pay for the coverage they need.

How is spot insurance different from traditional insurance?

Spot insurance provides instant access to coverage through a mobile or web application, eliminating the need for lengthy interactions with insurance representatives. It also often has lower premiums due to reduced acquisition costs.

What is the growth potential of the on-demand insurance market?

The on-demand insurance market is expected to increase by nearly 30% by 2026, driven by consumer demand for more convenient and flexible insurance options.

Which providers offer spot insurance coverage?

Some on-demand insurance providers that offer spot insurance coverage include Metromile, Thimble, and Spot. These providers offer different types of coverage, such as personal auto, commercial liability, and accidental injury coverage.

What are the challenges of on-demand insurance?

Challenges include the risk of moral hazard, difficulty verifying applicant responses, and potential for fraudulent claims. On-demand policies also often have concentrated exposure, resulting in higher rates.

What are the regulatory considerations for on-demand insurance?

On-demand insurance programs may face regulatory difficulties due to unique rating, form, and program features. State insurance departments may have different requirements for reviewing and approving on-demand insurance products.

How can spot insurance benefit businesses?

Spot insurance can provide additional revenue streams and enhance customer care for businesses. It offers flexible and customizable coverage options, adding value and security for customers and mitigating potential risks.

What is the summary of spot insurance?

Spot insurance is a flexible and customizable on-demand insurance option that offers convenience, control, instant access, and expense savings. It is a valuable and convenient choice for policyholders seeking personalized coverage.

It's great that you talked about how business insurance can provide financial protection against unexpected events and help ensure the…

I like that you mentioned how business insurance is essential for protecting your bottom line and the long-term viability of…