What is Cryptocurrency

You’re about to embark on a journey to uncover the secrets of the ever-evolving digital currency world. In this article, we will demystify the concept of cryptocurrency and unravel its mysteries. Get ready to delve into the fascinating realm of virtual currencies and discover the inner workings behind this revolutionary financial phenomenon. So, fasten your seatbelt and get ready to explore the captivating world of cryptocurrency!

What is Cryptocurrency

Cryptocurrency is a digital or virtual form of currency that uses cryptography for secure financial transactions, control the creation of additional units, and verify the transfer of assets. It is based on blockchain technology, a decentralized and distributed ledger that records all transactions across numerous computers globally. Unlike traditional fiat currency, cryptocurrencies are not issued or regulated by any central authority, such as a government or financial institution.

Definition of Cryptocurrency

Cryptocurrency can be defined as a type of digital or virtual currency that utilizes cryptography for security and operates independently of any central authority. It enables secure peer-to-peer transactions and allows users to store, send, and receive digital assets in a decentralized manner.

History of Cryptocurrency

The concept of cryptocurrencies dates back to the late 20th century, but it was not until the early 2000s that the first functional cryptocurrency was introduced. In 2009, Bitcoin, created by an anonymous individual or group using the pseudonym Satoshi Nakamoto, became the pioneer of cryptocurrencies. Bitcoin introduced the concept of blockchain technology, which revolutionized the way financial transactions are conducted.

Since then, the cryptocurrency market has experienced rapid growth and innovation, with various other cryptocurrencies emerging to address different use cases and technological advancements. The history of cryptocurrency is marked by significant milestones, including the introduction of smart contracts by Ethereum, the rise of alternative cryptocurrencies like Ripple and Litecoin, and the scalability improvements brought about by Bitcoin Cash.

Key Characteristics of Cryptocurrency

Cryptocurrencies possess several key characteristics that distinguish them from traditional forms of currency. These characteristics include:

-

Decentralization: Cryptocurrencies operate on decentralized networks, unlike traditional currencies that are controlled by centralized authorities such as central banks. Decentralization enhances security, transparency, and eliminates the need for intermediaries.

-

Security and Privacy: Cryptocurrencies utilize cryptographic techniques to secure transactions and control the creation of new units. This ensures that transactions are secure, private, and resistant to fraud and counterfeit.

-

Limited Supply: Most cryptocurrencies have a predetermined maximum supply, making them deflationary in nature. This limited supply helps maintain value and prevents excessive inflation.

-

Global Accessibility: Cryptocurrencies enable borderless transactions, allowing anyone with an internet connection to participate in the global economy. This inclusivity promotes financial inclusion and empowers individuals in regions with limited access to traditional banking services.

-

Fast and Low-Cost Transactions: Cryptocurrencies allow for fast and low-cost transactions, enabling frictionless peer-to-peer transfers of value. This provides an efficient alternative to traditional financial systems, which often involve slower settlement times and higher transaction fees.

Types of Cryptocurrencies

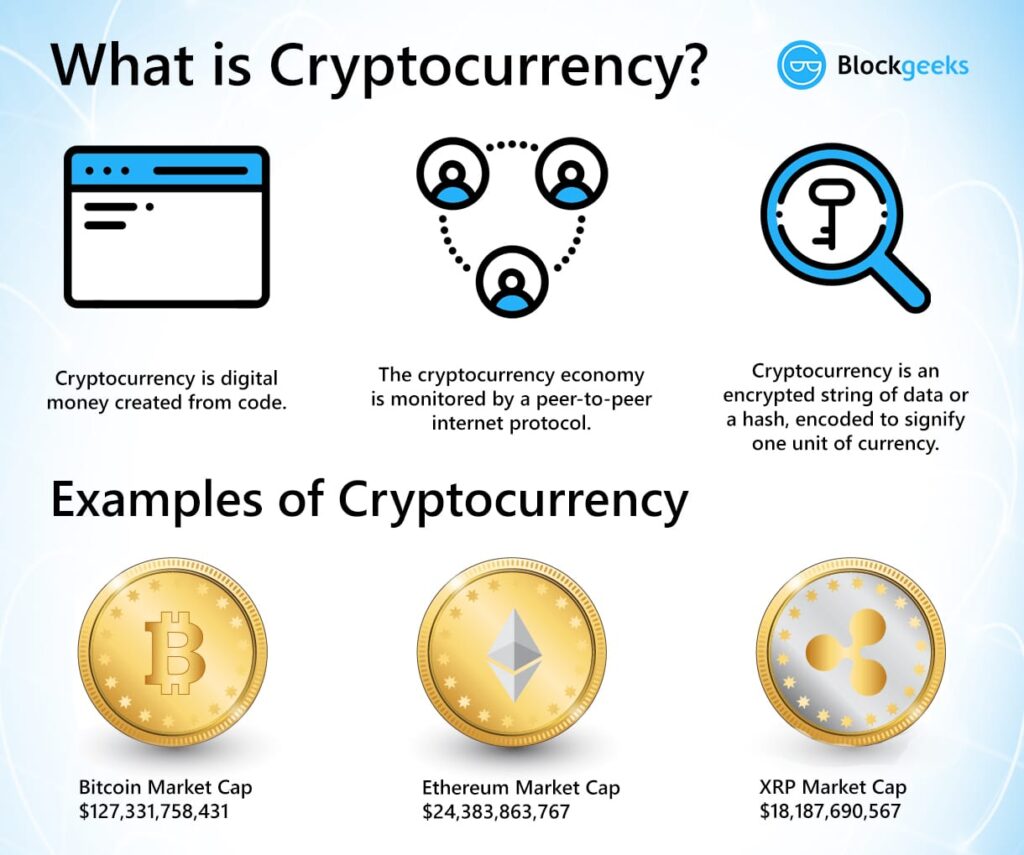

There are numerous cryptocurrencies in existence, each with its own unique features and purposes. The following are some of the most well-known and widely used cryptocurrencies:

Bitcoin

Bitcoin, often referred to as the original cryptocurrency, was introduced in 2009. It serves as a decentralized digital currency and a store of value. Bitcoin operates on a global network of computers that validate and secure transactions through cryptographic proof.

Ethereum

Ethereum is a decentralized, open-source blockchain platform that supports smart contracts and the development of decentralized applications (DApps). It has its own native cryptocurrency called Ether (ETH), which is used to facilitate transactions and pay for computational services on the network.

Ripple

Ripple offers a real-time gross settlement system and currency exchange network. Its native cryptocurrency, XRP, is used as a bridge currency for facilitating fast and low-cost international money transfers. Ripple aims to improve the efficiency of cross-border payments for financial institutions.

Litecoin

Litecoin, often referred to as the silver to Bitcoin’s gold, is a peer-to-peer cryptocurrency that was created as a fork of Bitcoin. It offers faster block generation times and a different hashing algorithm, making it more efficient for everyday transactions.

Bitcoin Cash

Bitcoin Cash is a cryptocurrency that was created in 2017 as a result of a hard fork from Bitcoin. It addresses some of the scalability issues of Bitcoin by increasing the block size, allowing for more transactions to be processed per block.

Cardano

Cardano is a blockchain platform that aims to provide a secure and scalable infrastructure for the development of decentralized applications and smart contracts. Its native cryptocurrency is called ADA.

Stellar

Stellar is a blockchain-based platform designed to facilitate fast, low-cost cross-border payments and remittances. Its native cryptocurrency, Lumens (XLM), serves as a bridge currency and facilitates the conversion of different fiat currencies.

IOTA

IOTA is a cryptocurrency that is designed for the Internet of Things (IoT). It aims to provide a secure and scalable infrastructure for machine-to-machine transactions and data transfer in an IoT ecosystem.

NEO

NEO is a blockchain platform that enables the creation of decentralized applications and smart contracts. It aims to digitize and automate the management of assets using blockchain technology. Its native cryptocurrency is called NEO.

Dash

Dash, short for “digital cash,” is a cryptocurrency that places emphasis on privacy and instant transactions. It offers features such as PrivateSend, which enhances transaction privacy, and InstantSend, which enables near-instant confirmations of transactions.

How Cryptocurrency Works

Cryptocurrencies operate based on several key principles and technologies that enable secure and decentralized transactions. Understanding how cryptocurrency works is crucial in grasping the potential of this revolutionary form of currency.

Cryptographic Techniques

Cryptocurrencies rely on cryptographic techniques to secure transactions and control the creation of new units. Cryptography uses advanced mathematical algorithms and encryption methods to ensure the confidentiality, integrity, and authenticity of data.

Decentralized Systems

Cryptocurrencies operate on decentralized systems, meaning that there is no central authority or intermediary controlling the network. Instead, transactions and data are verified and recorded across multiple computers or nodes, distributed globally.

Peer-to-Peer Transactions

Cryptocurrencies enable direct peer-to-peer transactions without the need for intermediaries, such as banks or payment processors. This allows users to transact directly with each other, reducing costs and increasing efficiency.

Blockchain Technology

Blockchain technology is a critical component of cryptocurrency. It is a decentralized and distributed ledger that records all transactions across numerous computers globally. Each transaction is bundled into a block and linked to the previous blocks, forming a chain of transactions. This creates a transparent and immutable record of all transactions.

Mining Process

Many cryptocurrencies, such as Bitcoin, utilize a process called mining to validate and add new transactions to the blockchain. Mining involves solving complex mathematical problems, which requires significant computational power. Miners are rewarded with newly created cryptocurrency units for their efforts in securing the network and verifying transactions.

Advantages of Cryptocurrency

Cryptocurrency offers several advantages over traditional forms of currency and financial systems. These advantages include:

Security and Privacy

Cryptocurrencies utilize advanced cryptographic techniques to ensure the security and privacy of transactions. The use of public and private keys allows for secure and verifiable transactions, while pseudonymous addresses help protect user identities.

Lower Transaction Fees

Cryptocurrency transactions often involve significantly lower fees compared to traditional financial systems, especially for international transactions. This can result in cost savings, particularly for businesses that conduct frequent cross-border transactions.

Global Accessibility

Cryptocurrencies provide global accessibility, allowing anyone with an internet connection to participate in the global economy. This inclusivity can benefit individuals in regions with limited access to traditional banking services, empowering them economically.

Independence from Central Banks

Cryptocurrencies operate independently of central banks and governments. This means that they are not subject to the monetary policies and regulations imposed by central authorities, providing individuals with a greater degree of financial freedom.

Faster and Instant Transactions

Cryptocurrencies enable fast and near-instant transactions. Unlike traditional banking systems, which can involve lengthy processes and settlement times, cryptocurrency transactions can be completed in a matter of minutes or even seconds.

Disadvantages of Cryptocurrency

While there are numerous advantages to cryptocurrencies, they also come with certain disadvantages that must be considered:

Volatility

Cryptocurrencies are known for their high levels of volatility. The value of cryptocurrencies can fluctuate rapidly and unpredictably, making them potentially risky for investors and users. This volatility can be attributed to factors such as market speculation and limited liquidity.

Lack of Regulations

The regulatory landscape surrounding cryptocurrencies is still evolving and varies from country to country. The lack of unified regulations can create uncertainty and pose risks for investors and users. Additionally, the absence of regulations may enable fraudulent activities and scams.

Potential for Illicit Activities

The decentralized nature of cryptocurrencies can attract illicit activities, such as money laundering and the financing of illegal transactions. While cryptocurrencies strive for transparency and security, there have been instances of their misuse in criminal activities.

Irreversible Transactions

Once a cryptocurrency transaction is confirmed and added to the blockchain, it becomes nearly impossible to reverse. This lack of reversibility can be problematic in situations where transactions need to be canceled or disputed, such as in cases of fraudulent or erroneous transactions.

Less Widely Accepted

While the adoption and acceptance of cryptocurrencies have been growing, they are still not as widely accepted as traditional fiat currencies. The limited acceptance of cryptocurrencies can make it challenging to use them for everyday transactions and may require users to convert them into fiat currencies.

Popular Cryptocurrency Exchanges

Cryptocurrency exchanges are online platforms where users can buy, sell, and trade cryptocurrencies for fiat currencies or other digital assets. Some of the most popular cryptocurrency exchanges include:

Coinbase

Coinbase is one of the largest cryptocurrency exchanges globally and is known for its user-friendly interface and strong security measures. It supports a wide range of cryptocurrencies and offers services for both beginner and advanced traders.

Binance

Binance is a leading cryptocurrency exchange that offers a vast selection of cryptocurrencies for trading. It is known for its low trading fees, extensive range of trading pairs, and advanced trading features.

Kraken

Kraken is a well-established cryptocurrency exchange that offers a range of trading options and advanced features. It prioritizes security and compliance and has gained a solid reputation within the cryptocurrency community.

Bitstamp

Bitstamp is one of the oldest cryptocurrency exchanges, having been established in 2011. It offers a user-friendly trading platform and supports various cryptocurrencies and fiat currency trading pairs.

Gemini

Gemini is a regulated cryptocurrency exchange founded by the Winklevoss twins. It prioritizes security, compliance, and transparency and offers a user-friendly interface for both retail and institutional investors.

Bitfinex

Bitfinex is a cryptocurrency exchange that caters to both individual traders and institutional investors. It offers advanced trading features, margin trading, and various order types.

Bittrex

Bittrex is a US-based cryptocurrency exchange that focuses on security and compliance. It offers a wide range of cryptocurrencies for trading and is known for its robust security measures.

OKEx

OKEx is a cryptocurrency exchange that provides a comprehensive range of trading services. It offers spot trading, futures trading, options trading, and decentralized finance (DeFi) services.

Huobi

Huobi is a cryptocurrency exchange that offers a wide range of cryptocurrencies for trading and supports various trading pairs. It also provides liquidity solutions for institutional investors.

KuCoin

KuCoin is a cryptocurrency exchange known for its extensive selection of altcoins and its user-friendly interface. It offers a range of trading options, including spot trading and futures trading.

Cryptocurrency Wallets

Cryptocurrency wallets are digital tools that allow users to store, send, and receive their cryptocurrencies securely. There are different types of cryptocurrency wallets available, including:

Hardware Wallets

Hardware wallets are physical devices that store the user’s private keys offline in a secure manner. They are considered one of the most secure types of wallets as they are not connected to the internet, reducing the risk of hacking or malware attacks.

Software Wallets

Software wallets are applications or software programs that can be installed on a computer or mobile device. They enable users to manage their cryptocurrencies and interact with the blockchain. Software wallets can be further categorized into desktop wallets, mobile wallets, and web wallets.

Web Wallets

Web wallets are cryptocurrency wallets that are accessed through a web browser. They are convenient and easy to use, as they do not require any software installation. However, they are considered less secure compared to hardware wallets, as the private keys are stored online.

Mobile Wallets

Mobile wallets are cryptocurrency wallets that are designed to be used on mobile devices, such as smartphones or tablets. They offer portability and convenience, allowing users to manage their cryptocurrencies on the go. Mobile wallets can be either software wallets or hardware wallets with mobile compatibility.

Paper Wallets

Paper wallets involve generating a physical copy of the user’s public and private keys, usually in the form of a paper printout or a physical medium. Paper wallets are considered highly secure, as they are not susceptible to cyber attacks. However, they require careful storage to prevent loss or damage.

Cryptocurrency Market Cap

Cryptocurrency market cap refers to the total value of all cryptocurrencies in circulation. It provides insights into the overall size and market dominance of different cryptocurrencies. Understanding market cap is essential for evaluating the popularity and potential growth of cryptocurrencies.

Definition of Market Cap

Market cap is calculated by multiplying the total supply of a cryptocurrency by its current market price. It represents the total value of all circulating coins of a particular cryptocurrency. Market cap is often used as a metric to compare the relative size or valuation of different cryptocurrencies.

Top 10 Cryptocurrencies by Market Cap

As of [current date], the top 10 cryptocurrencies by market cap are [list top 10 cryptocurrencies]. The market cap of these cryptocurrencies can vary significantly, with Bitcoin typically occupying the top spot due to its widespread adoption and long-standing market presence.

Factors Affecting Market Cap

Several factors can influence the market cap of cryptocurrencies, including:

-

Demand and Adoption: The level of demand and adoption for a cryptocurrency can directly impact its market cap. Increased user adoption and institutional interest can drive up the market cap of a cryptocurrency.

-

Price Volatility: Price volatility can affect the market cap of cryptocurrencies. Significant price fluctuations can lead to rapid changes in market cap, especially for smaller cryptocurrencies.

-

Competition and Innovation: Competition among cryptocurrencies and the ability to innovate and differentiate themselves can impact market cap. Cryptocurrencies that offer unique features or solve specific pain points may attract more investors and users, potentially increasing their market cap.

-

Regulatory Environment: Regulatory developments and changes in the legal landscape can also influence the market cap of cryptocurrencies. Favorable regulations can boost market confidence, leading to increased adoption and market cap growth.

Market Cap vs. Coin Price

Market cap and coin price are two distinct measures used to evaluate cryptocurrencies:

-

Market cap: Market cap represents the total value of a cryptocurrency, calculated by multiplying its current price by the total supply. Market cap provides a broader view of a cryptocurrency’s valuation and market dominance.

-

Coin price: Coin price refers to the current price of a single unit of a cryptocurrency. Coin price can be influenced by various factors, such as supply and demand dynamics, market sentiment, and overall market conditions.

While coin price can indicate the value of an individual cryptocurrency unit, market cap offers a more holistic perspective on the overall size and popularity of a cryptocurrency within the broader market.

Cryptocurrency Regulations

Regulations surrounding cryptocurrencies vary across different countries and jurisdictions. Governments and regulatory bodies seek to strike a balance between promoting innovation and protecting consumers and investors. Key aspects of cryptocurrency regulations include:

Government Regulations

Governments worldwide are increasingly recognizing the importance of regulating cryptocurrencies to address concerns such as fraud, money laundering, and consumer protection. Some countries have embraced cryptocurrencies and blockchain technology, implementing favorable regulations and creating conducive environments for innovation. Others have taken a more cautious approach and introduced stricter regulations or outright bans.

Anti-Money Laundering (AML) Measures

In response to concerns about money laundering and terrorist financing, many countries have implemented anti-money laundering measures that apply to cryptocurrency businesses. These measures often require cryptocurrency exchanges and other service providers to implement robust know-your-customer (KYC) procedures and report suspicious activities to regulatory authorities.

Know Your Customer (KYC) Policies

KYC policies require cryptocurrency businesses to verify the identities of their customers to prevent fraud, money laundering, and other illegal activities. This typically involves collecting personal information such as government-issued identification documents and conducting ongoing monitoring of customer transactions.

Legal Status of Cryptocurrency

The legal status of cryptocurrencies varies from country to country. While some countries have explicitly legalized cryptocurrencies and provide regulatory frameworks, others have banned or restricted their use. The legal status of cryptocurrencies can significantly impact their adoption and usage within a particular jurisdiction.

Future of Cryptocurrency

The future of cryptocurrency holds immense potential as blockchain technology continues to evolve and gain mainstream acceptance. Several trends and developments are shaping the future of the cryptocurrency landscape:

Mass Adoption

Mass adoption of cryptocurrencies is a key milestone that the industry strives to achieve. As awareness and understanding of cryptocurrencies increase, more individuals and businesses are likely to embrace digital currencies for everyday transactions and financial interactions.

Integration into Traditional Financial Systems

Cryptocurrencies are increasingly being integrated into traditional financial systems. This integration may involve collaborations between traditional financial institutions and cryptocurrency platforms, as well as the development of hybrid systems that leverage the benefits of both.

Central Bank Digital Currencies (CBDCs)

Central banks around the world are exploring the concept of central bank digital currencies (CBDCs). CBDCs are digital representations of a country’s fiat currency issued and regulated by the central bank. The introduction of CBDCs could have significant implications for the future of cryptocurrencies and the broader financial ecosystem.

Technological Advancements

Technological advancements, such as scalability solutions, improved privacy features, and enhanced smart contract capabilities, are expected to drive innovation within the cryptocurrency space. These advancements aim to address existing limitations and expand the potential use cases for cryptocurrencies.

In conclusion, cryptocurrency represents a groundbreaking form of digital currency that offers numerous advantages over traditional financial systems. With the potential for increased security, lower transaction fees, global accessibility, and faster transactions, cryptocurrency is transforming the way we conduct financial transactions and interact with the global economy. While there are challenges and risks associated with cryptocurrency, such as volatility and regulatory uncertainties, the future of cryptocurrency holds promising opportunities for further innovation and adoption.

It's great that you talked about how business insurance can provide financial protection against unexpected events and help ensure the…

I like that you mentioned how business insurance is essential for protecting your bottom line and the long-term viability of…