Amigo Insurance: Affordable Coverage Simplified

Looking for affordable insurance coverage? Look no further than Amigo Insurance. At Amigo Insurance, we understand the importance of having quality coverage at a price you can afford. We believe that insurance should be simplified and accessible to everyone.

With Amigo Insurance, getting a competitive quote for auto insurance coverage is quick and easy. We offer a streamlined process that allows you to follow three simple steps: get your quote, review your options, and select your coverage. You can trust us to provide the coverage you need to protect against potential financial loss in case of an accident.

Our insurance policies are designed to meet your specific needs. Whether you’re looking for liability coverage, property coverage, or medical coverage, we have options that fit your requirements. We offer comprehensive coverage options that give you peace of mind on the road.

Don’t settle for overpriced insurance or inadequate coverage. At Amigo Insurance, we prioritize affordability without compromising on reliability. We offer competitive rates and discounts to help you save on your insurance premiums.

Ready to get started? Visit our website now to get your personalized insurance quote. Protect what matters most with Amigo Insurance.

- Amigo Insurance provides affordable coverage options

- Getting a quote is quick and easy

- They offer comprehensive coverage options

- Amigo Insurance prioritizes affordability

- They have competitive rates and discounts

Understanding Auto Insurance and Coverage

Auto insurance plays a crucial role in protecting you and your vehicle from financial losses. It is a contract between you and the insurance company, where you agree to pay a premium, and in return, the company agrees to cover your losses as defined in your policy. Let’s take a closer look at the different aspects of auto insurance coverage.

Liability Coverage

Liability coverage is an essential component of auto insurance. It protects you from legal responsibility for bodily injury or property damage caused to others in an accident where you are deemed at fault. In the event of a lawsuit, liability coverage helps cover legal fees and potential settlement costs.

Property Coverage

Property coverage provides financial protection for damage to or theft of your car. It covers repair costs or the value of your vehicle if it is stolen or deemed a total loss due to an accident or other covered perils. Having property coverage is crucial to ensure you can restore or replace your vehicle in case of any unfortunate incidents.

Medical Coverage

Medical coverage, also known as personal injury protection (PIP), covers the costs associated with treating injuries resulting from an accident. This coverage extends to medical expenses, lost wages, and even funeral expenses depending on the policy. Having medical coverage can alleviate the financial burden caused by injuries in an accident.

Amigo Insurance, a trusted provider, offers a range of auto insurance coverage options to meet your specific needs. Whether you require liability coverage, property coverage, or medical coverage, Amigo Insurance has you covered. Protect yourself, your vehicle, and others on the road by securing the right auto insurance policy.

“Auto insurance is more than just protecting your vehicle; it’s about safeguarding your financial well-being in the event of an accident or loss.”

Comparing coverage options table

| Insurance Company | Liability Coverage | Property Coverage | Medical Coverage |

|---|---|---|---|

| Amigo Insurance | ✓ | ✓ | ✓ |

| Competitor A | ✓ | ✓ | ✗ |

| Competitor B | ✓ | ✓ | ✓ |

Questions to Ask Your Insurance Agent

When it comes to choosing the right insurance coverage, it’s important to have all the necessary information. That’s why it’s crucial to ask the right questions when speaking with your insurance agent. By doing so, you can ensure that you have the appropriate coverage for your needs and get the most out of your insurance policy.

Here are some questions you should consider asking your insurance agent:

- What is the cost I can afford in case of an accident? Understanding your deductible and how it affects your premium is important. Your insurance agent can help you determine the right balance between a lower premium and a higher deductible, or vice versa.

- What is the level of service and ability to pay claims of the insurance company? It’s essential to choose an insurance company that has a strong reputation for providing excellent customer service and efficiently handling claims. This ensures that you’ll be taken care of in the event of an accident or loss.

- Are there any available discounts? Inquire about the discounts offered by your insurance company, such as good driver discounts, multiple policy discounts, or discounts for safety features on your vehicle. Taking advantage of these discounts can help you save on your insurance premiums.

- What is the procedure for filing and settling a claim? Understand the process of filing a claim, the documents required, and how long it typically takes to settle a claim. This knowledge will help you navigate the claims process smoothly if the need arises.

By asking these questions, you can gain a better understanding of your insurance coverage and make informed decisions when choosing the right policy for your needs.

If you’d like to learn more about insurance coverage and the importance of asking the right questions, contact your insurance agent today.

The Benefits of Amigo Insurance

When it comes to insurance coverage, Amigo Insurance stands out as a reliable option that provides affordable solutions. With a commitment to exceptional customer service and a range of coverage options, Amigo Insurance ensures that you can find the right policy to meet your needs.

One of the key advantages of choosing Amigo Insurance is their dedication to affordability. They understand that insurance can be a significant expense, so they strive to offer competitive rates that fit within your budget. By providing affordable coverage, Amigo Insurance enables you to protect what matters most without breaking the bank.

Reliability is another crucial aspect of Amigo Insurance’s offerings. As a trusted insurance provider, they have built a solid reputation for delivering reliable and comprehensive coverage. You can have peace of mind knowing that Amigo Insurance has your back, providing a safety net in case of unexpected events.

Amigo Insurance also excels in customer service. They prioritize the satisfaction of their clients, ensuring that you receive prompt and attentive assistance throughout your insurance journey. Whether you have questions about your policy or need to file a claim, their dedicated customer service team is always ready to assist you every step of the way.

Additionally, Amigo Insurance offers a range of discounts to help you save on your insurance premiums. They understand the importance of affordability, and the discounts they provide can make a significant difference in the cost of your coverage. By taking advantage of these discounts, you can enjoy even greater value for your insurance investment.

With Amigo Insurance, you get the best of both worlds – affordable coverage and exceptional customer service. Protect yourself and your assets with a reliable insurance provider that understands your needs.

Amigo Insurance: Industry Rankings and Scorecard

Amigo Insurance is committed to providing reliable coverage backed by strong financial strength and high industry ratings. These factors contribute to the company’s reputation as a trusted insurance provider. Let’s take a closer look at Amigo Insurance’s industry rankings and scorecard.

Financial Strength Rating: B1 by Moody’s

Moody’s, a globally recognized credit rating agency, has assigned Amigo Insurance a B1 rating for financial strength. This rating indicates that Amigo Insurance has a moderate level of financial stability. It reflects the company’s ability to meet its obligations and indicates a solid foundation to support its policyholders.

Better Business Bureau (BBB) Rating: A+

The Better Business Bureau (BBB) has awarded Amigo Insurance an A+ rating, which signifies their dedication to ethical business practices and commitment to customer satisfaction. The A+ rating is the highest possible rating a company can receive from the BBB and represents Amigo Insurance’s exemplary standards when it comes to fulfilling customer needs and resolving any issues that may arise.

While specific information about Amigo Insurance’s claims satisfaction is limited, these industry rankings and ratings provide valuable insights into the company’s overall reliability and credibility. The B1 rating from Moody’s and the A+ rating from the BBB illustrate that Amigo Insurance is a reputable insurance provider you can trust.

Amigo Insurance: Industry Rankings and Scorecard Overview

| Industry Rankings | Scorecard |

|---|---|

| Financial Strength | B1 (Moody’s) |

| Better Business Bureau (BBB) Rating | A+ |

These industry rankings and scorecard reaffirm Amigo Insurance’s commitment to providing dependable coverage and exceptional service to its customers. With their strong financial standing and high BBB rating, Amigo Insurance demonstrates their dedication to delivering peace of mind to policyholders.

Understanding Amigo Insurance Quotes Based on Driver History

When it comes to getting an insurance quote from Amigo Insurance, your driver history plays a significant role. Your driving record can impact the insurance rates you receive, as insurers assess the level of risk you pose based on past behavior behind the wheel.

For individuals with a clean driving record, Amigo Insurance often offers more affordable quotes. This means that if you have not been involved in any accidents, have not received any speeding tickets, or have not been convicted of a DUI, you may enjoy lower insurance rates.

However, if you have a history of at-fault accidents, speeding tickets, or a DUI conviction, you may face higher insurance premiums. Insurance providers typically consider these incidents as indicators of higher risk, which may lead to increased rates to offset potential future claims.

It’s important to note that the impact of these factors on your insurance quotes may vary. Some insurance companies may place more weight on certain violations or incidents than others, which is why it’s crucial to compare quotes from different insurers to find the best rate for your specific situation.

To better understand how your driver history affects your insurance quotes, here is a breakdown of how different violations and incidents can impact insurance rates based on Amigo Insurance guidelines:

| Driver History | Impact on Insurance Quotes |

|---|---|

| Clean record (no violations or accidents) | Lower insurance rates |

| At-fault accident | Higher insurance rates |

| Speeding ticket | Potential increase in insurance rates |

| DUI conviction | Significantly higher insurance rates |

As you can see, maintaining a clean driving record can help you secure more affordable insurance coverage. However, if you have previous violations or accidents on your record, it’s still possible to find competitive quotes by comparing different insurance providers.

Amigo Insurance: Coverage Options and Discounts

When it comes to insurance coverage, Amigo Insurance offers a variety of options to meet your specific needs. Whether you’re looking for liability, comprehensive, or collision coverage, Amigo Insurance has got you covered. Their range of coverage options ensures that you can tailor your policy to protect what matters most to you.

In addition to their comprehensive coverage, Amigo Insurance also provides discounts to help you save on your insurance premiums. By taking advantage of their discounts, you can enjoy the peace of mind that comes with knowing you’re protected at an affordable price.

Let’s take a closer look at the coverage options and discounts available from Amigo Insurance:

Liability Coverage

Liability coverage is a crucial component of any insurance policy. It protects you financially if you’re found responsible for causing bodily injury or property damage to others in an accident. With Amigo Insurance, you can select the liability coverage limits that best suit your needs and budget.

Comprehensive Coverage

Comprehensive coverage provides protection against non-collision-related incidents, such as theft, vandalism, or damage caused by natural disasters. Amigo Insurance’s comprehensive coverage ensures that you’re prepared for unexpected events that may result in damage or loss to your vehicle.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in a collision, regardless of fault. This coverage is particularly important if you have a loan or lease on your vehicle. With collision coverage from Amigo Insurance, you can drive with confidence, knowing that you’re financially protected in the event of an accident.

Now, let’s talk about the discounts offered by Amigo Insurance:

Driver-Based Discounts

Amigo Insurance rewards safe driving habits by offering driver-based discounts. If you have a clean driving record, you may be eligible for lower premiums. This discount encourages responsible driving and helps you save on your insurance costs.

Bundling Discounts

By bundling your auto insurance policy with other insurance products, such as home or renters insurance, you can enjoy additional savings. Amigo Insurance offers bundling discounts, making it easier and more affordable to protect your assets with a comprehensive insurance package.

Exploring these coverage options and discounts can help you find the right policy that fits your needs and budget. Take advantage of Amigo Insurance’s affordable rates and reliable coverage to ensure you have the protection you need on the road.

| Coverage Options | Discounts |

|---|---|

| Liability | Driver-Based Discounts |

| Comprehensive | Bundling Discounts |

| Collision |

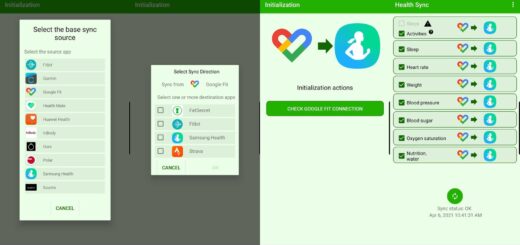

Take a look at this image that highlights Amigo Insurance’s coverage options and discounts:

Amigo Insurance Reputation

When it comes to reputation, Amigo Insurance has garnered generally positive reviews from customers. The company is known for its commitment to providing reliable insurance coverage and excellent customer service. However, some customers have reported difficulties reaching agents and frustrations with the claims process.

Despite these occasional challenges, Amigo Insurance has managed to maintain a good reputation in the industry. Customers appreciate the company’s affordable insurance options and the peace of mind that comes with knowing they are protected by a trusted provider.

“I have been with Amigo Insurance for several years now, and they have always been there when I needed them. The customer service team is friendly and helpful, and I feel confident in their ability to handle my claims efficiently.” – Sandra, Amigo Insurance customer

While it’s essential to acknowledge the occasional hiccups in the claims process, the overwhelming majority of customers have had positive experiences with Amigo Insurance. The company’s dedication to providing reliable coverage and its efforts to resolve any issues that arise have contributed to its solid reputation.

Customer Service Excellence

Amigo Insurance prides itself on delivering exceptional customer service. The company understands the importance of promptly addressing customer inquiries and concerns. However, some customers have mentioned experiencing delays in reaching agents.

Despite these isolated incidents, Amigo Insurance remains committed to continuously improving the customer service experience and streamlining communication channels for a smoother interaction with their team.

The Claims Process

While the majority of claims are handled efficiently and effectively, some customers have expressed frustration with the claims process. It is essential to note that claims processes can vary depending on the circumstances and the complexity of each case.

As an insurance provider, Amigo Insurance is dedicated to resolving claims as quickly and fairly as possible. They work diligently to ensure that customers receive the support and compensation they are entitled to in their time of need.

| Amigo Insurance Reputation | Customer Service | Claims Process |

|---|---|---|

| Generally positive | Good overall, occasional difficulties in reaching agents | Efficient, but some customer frustrations reported |

Is Amigo Insurance Right for You?

The decision of whether Amigo Insurance is the right choice for you depends on your specific coverage needs and affordability. If you are looking for affordable insurance coverage from a reputable company, Amigo Insurance could be a good option. However, it’s important to compare quotes and consider your individual circumstances before making a decision.

Insurance coverage is an essential aspect of financial planning. It provides protection against potential risks and ensures peace of mind. Choosing the right insurance provider, such as Amigo Insurance, can make all the difference in meeting your coverage needs.

Understanding Your Coverage Needs

Before selecting any insurance provider, it’s crucial to determine your specific coverage needs. Consider factors such as:

- The type of coverage required (e.g., auto, home, health)

- The desired coverage limits

- Additional coverage options you may need

By understanding your coverage needs, you can evaluate whether Amigo Insurance offers the policies that align with your requirements.

Considering Affordability

Affordability plays a vital role in choosing an insurance provider. Insurance premiums should be within your budget while still offering adequate coverage. Amigo Insurance aims to provide affordable insurance coverage options, ensuring that you can protect yourself without straining your finances.

When assessing affordability, consider:

- The cost of premiums for the desired coverage

- Potential discounts that could lower your premium

- The ease of payment options

By evaluating affordability, you can determine whether Amigo Insurance is financially viable for your insurance needs.

Comparing Quotes

Comparing insurance quotes is an essential step in finding the right insurance provider. Take the time to request quotes from different companies, including Amigo Insurance, to compare coverage options and prices. This allows you to make an informed decision based on your coverage needs and budget.

When comparing quotes, consider:

- The coverage offered by each provider

- The premium costs

- Additional benefits or discounts available

A careful comparison of insurance quotes will help you determine whether Amigo Insurance offers the right coverage at a competitive price.

Conclusion

Choosing the right insurance coverage is an important decision, and Amigo Insurance offers reliable and affordable options to meet your needs. With their range of insurance options, you can find the coverage that suits you best. Whether you’re looking for liability coverage, comprehensive coverage, or collision coverage, Amigo Insurance has you covered.

Amigo Insurance has a strong industry reputation, with high ratings for financial strength and customer satisfaction. Their commitment to providing excellent customer service ensures that you’ll have the support you need throughout the claims process. When it comes to insurance, you want a provider you can trust, and Amigo Insurance fits the bill.

Don’t forget to ask the right questions when speaking with an insurance agent. By understanding your coverage needs and comparing quotes, you can make an informed decision about choosing Amigo Insurance. Their affordable rates, reliable coverage, and various insurance options make them a top choice for individuals and families alike.

FAQ

How can I get a quote for auto insurance coverage from Amigo Insurance?

Getting a quote from Amigo Insurance is quick and easy. Follow three simple steps to get your quote, review your options, and select your coverage.

What is auto insurance?

Auto insurance is a contract between you and an insurance company. You agree to pay a premium, and the company agrees to cover your losses as defined in your policy.

What does auto insurance cover?

Auto insurance provides property coverage for damage or theft of your car, liability coverage for your legal responsibility for others’ injury or property damage, and medical coverage for treating injuries.

What are important questions to ask my insurance agent?

Important questions include asking about cost, the insurance company’s ability to pay claims, available discounts, and the procedure for filing and settling a claim.

Is Amigo Insurance a reliable insurance company?

Yes, Amigo Insurance is a reliable insurance company that offers affordable coverage options. They prioritize customer service and have a range of discounts available.

What industry rankings does Amigo Insurance have?

Amigo Insurance has a B1 rating from Moody’s for financial strength and an A+ rating from the Better Business Bureau (BBB).

How do Amigo Insurance quotes vary based on driver history?

Amigo Insurance offers quotes based on driver history. Clean records tend to have lower insurance rates, while high-risk drivers may pay more.

What coverage options does Amigo Insurance provide?

Amigo Insurance provides various coverage options, including liability, comprehensive, and collision coverage. They also offer discounts to help you save on premiums.

What is Amigo Insurance’s reputation for customer service and claims process?

Amigo Insurance has generally positive reviews for customer service and the claims process. However, some customers have had difficulty reaching agents and frustration with the claims process.

Is Amigo Insurance the right choice for me?

The decision depends on your coverage needs and affordability. Amigo Insurance offers affordable and reliable coverage, but it’s important to compare quotes and consider your circumstances.

It's great that you talked about how business insurance can provide financial protection against unexpected events and help ensure the…

I like that you mentioned how business insurance is essential for protecting your bottom line and the long-term viability of…